WTMS Blog Today = What’s up in Mortgage Today (AM) – 12/04/2025

Jobless claims just dropped to 191,000 – the lowest reading since 2022 and one of the best readings since the 1960s. While this sounds positive for the economy, it’s causing bond prices to fall and mortgage rates to climb higher. The strong labor data suggests the Fed may be less aggressive with rate cuts, putting upward pressure on your client rates.

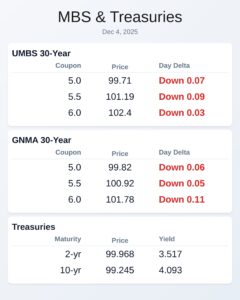

UMBS securities are down 3 to 9 basis points across all coupons this morning. The 30-year UMBS 5.0 coupon fell to 99.71, while the 5.5 coupon dropped to 101.19. These declines translate directly to higher mortgage rates for borrowers applying today.

The 10-year Treasury yield jumped 3 basis points to 4.093%, moving closer to long-term resistance levels. Treasury yields were already trending higher overnight before the jobless claims data hit. The strong employment picture is making investors question whether the Fed needs to continue cutting rates as aggressively as previously expected.

Home prices are showing signs of cooling nationwide, with 44 states experiencing flat or negative price changes over the past three months. This normalization could actually benefit mortgage-backed securities investors by improving convexity as loan sizes stabilize. For mortgage sellers, slower home price appreciation means borrowers may face less equity buildup but potentially more affordable entry points.

Builder incentives continue to dominate the new construction market, with D.R. Horton offering 3.99% mortgages plus 3% home discounts. Lennar reported $64,000 in average buyer incentives last quarter.

These builder-backed rate buydowns create significant competition for traditional mortgage originators trying to win purchase business.

Locking vs Floating

Bonds are trading with mid-week volatility despite showing some disinterest in economic data. Rates are approaching long-term resistance levels, meaning a significant break lower would require major data developments.

Random in-range volatility is expected through next Wednesday’s Fed announcement, suggesting caution for floating strategies.

Today’s Events

Challenger layoffs (Nov): 71.3K vs 153.1K prior

Continued Claims (Nov 22): 1,939K vs 1,960K forecast, 1,960K prior

Jobless Claims (Nov 29): 191K vs 220K forecast, 216K prior

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.71 | -0.07 |

| 5.5 | 101.19 | -0.09 |

| 6.0 | 102.4 | -0.03 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.82 | -0.06 |

| 5.5 | 100.92 | -0.05 |

| 6.0 | 101.78 | -0.11 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.517 | 99.968 | 0.027 |

| 3 yr | 3.538 | 99.894 | 0.035 |

| 5 yr | 3.665 | 99.817 | 0.035 |

| 7 yr | 3.861 | 99.327 | 0.034 |

| 10 yr | 4.093 | 99.245 | 0.03 |

| 30 yr | 4.751 | 98.001 | 0.02 |