WTMS Blog Today = What’s up in Mortgage Today (AM) – 12/05/2025

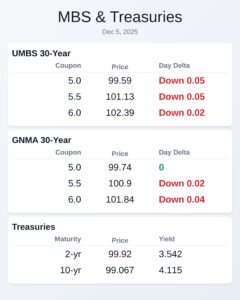

Mortgage bonds are showing modest weakness this morning despite inconsequential economic data releases. UMBS 5.0 coupons dropped to 99.59, down 5 basis points from yesterday’s close. The 10-year Treasury yield climbed 1.5 basis points to 4.115%, putting pressure on mortgage pricing.

Consumer sentiment data came in slightly better than expected at 53.3 versus a 52 forecast. Inflation expectations continue their downward trend, with 1-year expectations dropping to 4.1% from 4.5% previously. This modest improvement in sentiment hasn’t translated into meaningful bond market gains.

Core PCE data for September matched expectations at 0.2% month-over-month growth. The yearly reading of 2.8% came in below the 2.9% forecast, supporting the Fed’s gradual approach to rate cuts. Personal income rose 0.4%, slightly beating the 0.3% estimate and indicating continued consumer spending power.

Ginnie Mae securities remain relatively stable with GNMA 5.0 coupons unchanged at 99.74. The government-backed securities are outperforming their conventional counterparts in today’s session. This performance gap reflects ongoing investor preference for government backing amid political uncertainty.

Locking vs Floating

Bonds are trading well regardless of economic data, suggesting market disinterest in today’s releases. Rates are approaching long-term resistance levels from a technical standpoint. Random, in-range volatility is expected between now and next Wednesday’s Fed announcement, with heavier event risk surrounding the Federal Reserve meeting.

Today’s Events

– Consumer Sentiment (Dec): 53.3 vs 52 forecast, 51.0 previous

– Sentiment: 1y Inflation (Dec): 4.1% vs 4.5% previous

– Core PCE (m/m) (Sep): 0.2% vs 0.2% forecast, 0.2% previous

– Core PCE Inflation (y/y) (Sep): 2.8% vs 2.9% forecast, 2.9% previous

– Personal Income (Sep): 0.4% vs 0.3% forecast, 0.4% previous

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.59 | -0.05 |

| 5.5 | 101.13 | -0.05 |

| 6.0 | 102.39 | -0.02 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.74 | 0 |

| 5.5 | 100.9 | -0.02 |

| 6.0 | 101.84 | -0.04 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.542 | 99.92 | 0.019 |

| 3 yr | 3.564 | 99.82 | 0.02 |

| 5 yr | 3.69 | 99.708 | 0.015 |

| 7 yr | 3.883 | 99.194 | 0.014 |

| 10 yr | 4.115 | 99.067 | 0.015 |

| 30 yr | 4.776 | 97.603 | 0.018 |