WTMS Blog Today = What’s up in Mortgage Today (AM) – 12/09/2025

JOLTS job openings data slammed the mortgage market this morning, sending yields higher and MBS prices lower. The October report showed 7.67 million job openings versus expectations of around 7.2 million, a clear sign of labor market strength. This reading was significantly higher than August’s level, creating immediate selling pressure in bonds.

For mortgage originators, this translates to higher rates for borrowers applying today. The 10-year Treasury yield jumped to 4.18% after the data release, erasing earlier gains. MBS securities fell nearly a quarter point, with UMBS 5.0 coupons dropping to 99.21.

The only silver lining was the “quits” component falling to cycle lows, which prevented even steeper losses. When job openings surge this dramatically, it signals the Fed may need to remain more hawkish than previously expected. Federal Reserve Chair Jerome Powell faces his final policy meeting before leaving office, with a 25 basis point cut still expected Wednesday.

However, markets have dialed back expectations for 2026 cuts, now pricing only two reductions next year. This hawkish shift reflects concerns about persistent labor market tightness and potential inflation pressures. Powell’s press conference will be scrutinized for any hints about the transition to his successor, likely Kevin Hassett.

Credit report costs continue climbing, with another significant increase expected in 2026 according to industry sources. Lenders are increasingly questioning whether to treat credit pulls as lead generation tools or final approval steps. Some originators are shifting to soft-pull credit early in the process, reserving expensive tri-merge reports until borrowers are under contract.

This strategic change could save thousands per month while improving the consumer experience.

Locking vs Floating

Assume higher volatility through mid-January, with bonds moving on both economic data and random market swings. This week’s primary risks include Tuesday’s JOLTS data (already released) and Wednesday’s Fed announcement.

Between now and then, events carry significant risk, though bonds have shown willingness to move without obvious catalysts. MBS prices provide intraday guidance, but 10-year yield levels offer better insight into broader bond market momentum.

Today’s Events

ADP Employment Change Weekly: 4.75K vs previous -13.5K

CB Leading Index MoM (Sep): -0.3% vs -0.3% forecast, -0.5% previous

JOLTS Job Quits (Sep): 3.128M vs previous 3.091M

JOLTS Job Quits (Oct): 2.941M vs no previous reading

USA JOLTS Job Openings (Sep): 7.658M vs 7.2M forecast, 7.227M previous

USA JOLTS Job Openings (Oct): 7.670M vs previous 7.658M

Bond Pricing

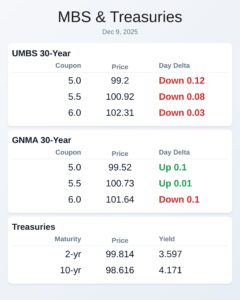

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.2 | -0.12 |

| 5.5 | 100.92 | -0.08 |

| 6.0 | 102.31 | -0.03 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.52 | 0.1 |

| 5.5 | 100.73 | 0.01 |

| 6.0 | 101.64 | -0.1 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.597 | 99.814 | 0.024 |

| 3 yr | 3.629 | 99.637 | 0.019 |

| 5 yr | 3.765 | 99.368 | 0.019 |

| 7 yr | 3.952 | 98.778 | 0.012 |

| 10 yr | 4.171 | 98.616 | 0.008 |

| 30 yr | 4.796 | 97.298 | -0.013 |