WTMS Blog Today = What’s up in Mortgage Today (AM) – 12/10/2025

The Federal Reserve’s dot plot dominates today’s mortgage market conversation. Bond markets opened with modest weakness overnight but recovered after this morning’s Employment Cost Index came in lighter than expected. This means 10-year yields are sitting at the edge of their three-month range heading into this afternoon’s Fed announcement.

The rate cut itself is essentially guaranteed, so all eyes are on the updated dot plot projections for 2026. The last dot plot showed one more cut in 2025 and one additional cut in 2026, but those 2026 dots are much more dispersed. Recent hawkish speeches from Fed officials raise the risk that some central dots might migrate upward, effectively suggesting the Fed could be done cutting rates after today.

Mortgage applications data showed refinance demand surged 14% last week as borrowers rushed to capitalize on temporary rate improvements. The refinance share of total applications jumped to 58.2% from 53.0% the previous week. Purchase applications dropped 2% but remained 19% higher than the same week one year ago, with FHA applications seeing a 5% increase as buyers seek lower down payment options.

Treasury markets continue their cautious advance with the 10-year rate rising to 4.21%, the highest level since early September. Global bond markets are reflecting growing expectations that rate-cutting cycles worldwide are nearing their end. This view has pushed yields on a Bloomberg gauge of long-dated government debt to a 16-year high.

Locking vs Floating

Market volatility is expected to remain elevated through the second week of January. Today’s biggest risk comes from the Fed’s dot plot release and Jerome Powell’s press conference scheduled for this afternoon. Employment cost data showed some cooling at 0.8% versus the 0.9% forecast, but bond markets have been moving without obvious catalysts recently, making prediction difficult.

Today’s Events

– Employment costs Q3: 0.8% vs 0.9% f’cast, 0.9% prev

– 2:00 PM: Fed Interest Rate Decision

– 2:00 PM: FOMC Economic Projections

– 2:30 PM: Fed Press Conference

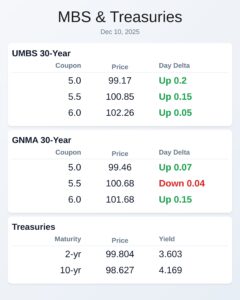

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.17 | 0.2 |

| 5.5 | 100.85 | 0.15 |

| 6.0 | 102.26 | 0.05 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.46 | 0.07 |

| 5.5 | 100.68 | -0.04 |

| 6.0 | 101.68 | 0.15 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.603 | 99.804 | -0.011 |

| 3 yr | 3.642 | 99.6 | -0.011 |

| 5 yr | 3.775 | 99.321 | -0.008 |

| 7 yr | 3.961 | 98.723 | -0.01 |

| 10 yr | 4.169 | 98.627 | -0.017 |

| 30 yr | 4.784 | 97.477 | -0.025 |