WTMS Blog Today = What’s up in Mortgage Today (AM) – 12/12/2025

Market traders are choosing their own adventure today as Treasury yields split directions after the Fed’s rate cut. The 10-year yield pushed 4 basis points higher to 4.186% while 2-year yields barely budged, creating a noticeable divergence that’s becoming more pronounced since Wednesday’s Fed meeting. This spread means longer-term mortgage pricing could face more pressure even as short-term rates remain anchored by Fed policy.

Chicago Fed President Goolsbee threw cold water on the recent rate cut this morning, stating there was little evidence the labor market was deteriorating enough to justify this week’s move. His comments highlight growing concern among Fed officials that they may have acted prematurely without sufficient economic data. If Tuesday’s jobs report shows strength, markets will increasingly view Wednesday’s rate cut as a policy mistake.

UMBS securities opened weaker with the 5.0 coupon down 17 basis points to 99.20, while GNMA bonds also declined across coupons. MBS traders are watching the yield curve steepening carefully, as it pressures lower-coupon 30-year mortgage bonds while benefiting adjustable-rate products. The curve movement reflects investors forcing long-term bonds to absorb selling pressure that short-term bonds can’t handle due to Fed policy constraints.

Industry forecasters expect 2026 mortgage rates to hover around 6%, offering only modest relief from this year’s 6.6% average. Multiple housing analysts including Redfin, Realtor.com, and the National Association of Realtors project rates between 6.0% and 6.3% next year. This would continue the slow drift lower in borrowing costs but won’t materially improve affordability for most homebuyers.

Locking vs Floating

The friendly market reaction to Wednesday’s Fed announcement helps reinforce the current trading range for mortgage pricing. Risk-tolerant clients should use the ceiling of this range as a lock trigger, while risk-averse borrowers can capitalize on any mid-day price improvements that develop. Volatility risk decreases over the next few days but will pick back up heading into the December 16th jobs report.

Today’s Events

– Jobless Claims: 236k vs 220k forecast

– Continued Claims: 1838k vs 1950k forecast

Bond Pricing

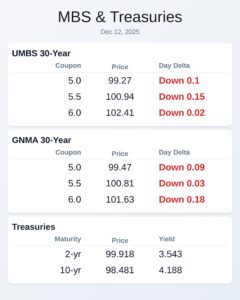

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.27 | -0.1 |

| 5.5 | 100.94 | -0.15 |

| 6.0 | 102.41 | -0.02 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.47 | -0.09 |

| 5.5 | 100.81 | -0.03 |

| 6.0 | 101.63 | -0.18 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.543 | 99.918 | 0.007 |

| 3 yr | 3.591 | 99.744 | 0.008 |

| 5 yr | 3.747 | 99.447 | 0.018 |

| 7 yr | 3.951 | 98.784 | 0.024 |

| 10 yr | 4.188 | 98.481 | 0.036 |

| 30 yr | 4.851 | 96.444 | 0.054 |