WTMS Blog Today = What’s up in Mortgage Today (AM) – 12/16/2025

November’s jobs data delivered a mixed bag that left mortgage markets struggling to find direction. The unemployment rate climbed to 4.6%, hitting a new cycle high since 2021, which should theoretically favor bond prices. However, job growth of 64,000 exceeded expectations of 50,000, while the labor force participation rate ticked higher to 62.5%.

The Bureau of Labor Statistics noted complications from the government shutdown affecting data collection reliability. October’s payroll numbers were revised dramatically downward to -105,000 jobs lost. Despite these labor market signals suggesting Fed easing bias, bond trading volume surged while prices remained frustratingly flat.

MBS initially jumped following the unemployment rate spike, gaining almost an eighth of a point. But that momentum quickly faded as traders parsed the nuanced details within the report. The 10-year Treasury yield dropped briefly to 4.149% before reversing course back toward 4.19%.

Retail sales data added another layer of complexity, coming in unchanged for October versus 0.1% expectations. The retail sales control group, which feeds into GDP calculations, surprised to the upside at 0.8% versus 0.4% forecasts. This consumer strength counterbalanced some of the labor market softness concerns.

Locking vs Floating

Current market conditions favor a cautious approach to floating loans. This week’s economic calendar centers on Tuesday’s jobs report and Thursday’s crucial CPI data. Monday and Wednesday evening present elevated risk for borrowers choosing to float rates.

MBS prices provide better intraday risk management compared to tracking 10-year yield movements. However, the 10-year yield ceilings and floors offer superior insight into broader bond market momentum trends.

Today’s Events

– ADP Weekly Employment: 16.25k vs 4.75k previous

– Non Farm Payrolls (Oct): -105k vs 119k previous

– Non Farm Payrolls (Nov): 64k vs 50k forecast

– Participation Rate (Nov): 62.5% vs 62.4% previous

– Retail Sales (Oct): 0.0% vs 0.1% forecast

– Retail Sales Control Group (Oct): 0.8% vs 0.4% forecast

– Unemployment Rate (Nov): 4.6% vs 4.4% forecast

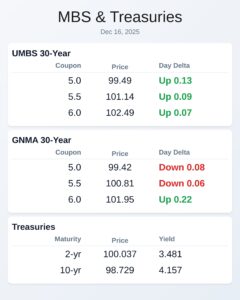

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.49 | 0.13 |

| 5.5 | 101.14 | 0.09 |

| 6.0 | 102.49 | 0.07 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.42 | -0.08 |

| 5.5 | 100.81 | -0.06 |

| 6.0 | 101.95 | 0.22 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.481 | 100.037 | -0.024 |

| 3 yr | 3.527 | 99.924 | -0.024 |

| 5 yr | 3.698 | 99.671 | -0.029 |

| 7 yr | 3.907 | 99.047 | -0.025 |

| 10 yr | 4.157 | 98.729 | -0.02 |

| 30 yr | 4.833 | 96.727 | -0.012 |