WTMS Blog Today = What’s up in Mortgage Today (AM) – 12/22/2025

Bond markets have effectively closed for business in 2025 as holiday trading takes hold. The mortgage securities market showed modest weakness this morning with UMBS 5.0 prices down 5 basis points. Treasury yields climbed slightly with the 10-year hitting 4.167%, continuing the sideways drift pattern we’ve seen for weeks.

The trading environment is entering peak holiday mode where light volume can create unpredictable price swings. Any major market moves this week should be taken with a grain of salt due to reduced liquidity. The next meaningful volatility won’t likely emerge until the first week of January.

Despite recent micro-movements keeping 10-year yields on the higher end of their 4-month range, MBS have been outperforming treasuries relative to their trading ranges. Two-year yields remain near the lower end of their recent range while mortgage securities hold the middle ground. This positioning suggests mortgage rates may remain relatively stable through year-end.

The Senate confirmed key financial regulatory appointments this week including Frank Cassidy as FHA Commissioner and Joe Gormley as Ginnie Mae President. These confirmations represent important stability for affordable housing initiatives heading into 2026. Three finalists are under consideration for the next Federal Reserve chair position, all supporting rate cuts but with different approaches to monetary policy.

MBS dealer holdings reached a record high of $135.4 billion according to recent New York Fed data. Treasury foreign investment flows showed the strongest Agency MBS buying in four months at $26.0 billion. This institutional demand provides underlying support for mortgage securities even as holiday trading creates temporary volatility.

Locking vs Floating

Holiday trading conditions create wider price movement ranges that can occur without clear fundamental reasons. Mortgage originators should expect rates to drift sideways through the remainder of December. The next risk for consequential market volatility won’t emerge until scheduled events resume in early January.

Today’s Events

– 1:00 PM: 2-Year Treasury Note Auction ($69 billion)

Bond Pricing

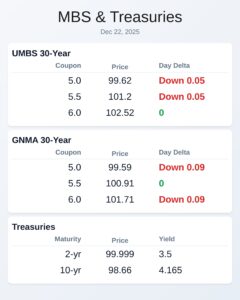

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.62 | -0.05 |

| 5.5 | 101.2 | -0.05 |

| 6.0 | 102.52 | 0 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.59 | -0.09 |

| 5.5 | 100.91 | 0 |

| 6.0 | 101.71 | -0.09 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.5 | 99.999 | 0.015 |

| 3 yr | 3.547 | 99.867 | 0.021 |

| 5 yr | 3.712 | 99.607 | 0.018 |

| 7 yr | 3.925 | 98.939 | 0.017 |

| 10 yr | 4.165 | 98.66 | 0.017 |

| 30 yr | 4.838 | 96.641 | 0.017 |