WTMS Blog Today = What’s up in Mortgage Today (AM) – 12/26/2025

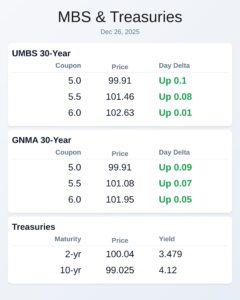

Bond markets posted decent gains this morning following yesterday’s successful 7-year Treasury auction. UMBS prices climbed across all coupons, with the 5.0 coupon rising 10 basis points to 99.91. This improvement offers mortgage originators slightly better pricing for loans closing before year-end.

Treasury yields moved lower across the curve, particularly in the belly of the curve. The 10-year yield dropped 12 basis points to 4.12%, while the 2-year fell 27 basis points to 3.479%. When Treasury yields decline, mortgage-backed securities typically benefit from increased investor demand.

Labor market data showed mixed signals today. Initial jobless claims fell to 214,000, beating the 223,000 forecast and indicating continued labor market strength. However, continuing claims rose to 1.923 million, suggesting some workers are having difficulty finding new employment after initial job loss.

The post-Christmas trading environment creates unique challenges for mortgage professionals. Thin liquidity can amplify price movements in either direction, even without major economic catalysts. Most institutional investors remain on holiday schedules, reducing overall market participation through the end of December.

Locking vs Floating

Bond markets have entered peak holiday mode, creating wider price ranges that can occur without apparent fundamental reasons. While the average December sees rates drift sideways in the second half of the month, current thin liquidity increases volatility risk. The next significant risk for consequential market movement won’t occur until the first week of January when normal trading volumes return.

Today’s Events

– Continued Claims (Dec 13): 1,923K vs 1,897K previous

– Jobless Claims (Dec 20): 214K vs 223K forecast, 224K previous

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.91 | 0.1 |

| 5.5 | 101.46 | 0.08 |

| 6.0 | 102.63 | 0.01 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.91 | 0.09 |

| 5.5 | 101.08 | 0.07 |

| 6.0 | 101.95 | 0.05 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.479 | 100.04 | -0.027 |

| 3 yr | 3.53 | 99.914 | -0.026 |

| 5 yr | 3.691 | 99.703 | -0.03 |

| 7 yr | 3.894 | 99.123 | -0.018 |

| 10 yr | 4.12 | 99.025 | -0.012 |

| 30 yr | 4.795 | 97.304 | -0.001 |