WTMS Blog Today = What’s up in Mortgage Today (PM) – 01/08/2026

European markets dragged U.S. bonds lower overnight, setting the stage for a challenging day. The morning’s jobless claims data failed to provide any relief, with bonds continuing to sell off across the Atlantic.

MBS prices fell an eighth of a point while the 10-year Treasury yield climbed 2.6 basis points to 4.181%. Trump’s announcement about increasing military spending by $500 billion in 2027 sent defense stocks higher but added pressure to bonds. The Treasury curve experienced bear steepening, with longer-term yields rising more than shorter ones.

This steepening pattern typically signals investor concerns about future inflation and government spending. December prepayment speeds rose 5% from November and jumped 49% year-over-year, indicating a gradual refinancing recovery. However, mortgage lock volume declined nearly 19% month-over-month according to MCT’s latest data.

Winter seasonality combined with government shutdown uncertainty kept borrowers cautious about major financial decisions. The trade deficit narrowed dramatically to $29.4 billion in October, well below the $58.7 billion consensus forecast. This unexpected improvement reflected sharp declines in imports, particularly pharmaceutical preparations and gold.

Productivity data showed a robust 4.9% quarterly increase, the largest jump since 2020.

Locking vs Floating

With rates at two-month lows but showing weakness, risk-averse clients should remain in lock mode. Wednesday’s economic data failed to inspire volatility, leaving Friday’s jobs report as the week’s main market mover.

Current market conditions favor protecting existing rate commitments rather than gambling on further improvements.

Today’s Events

Challenger layoffs (Dec): 35.553K vs 71.321K previous

Continued Claims (Dec 27): 1,914K vs 1,900K forecast, 1,866K previous

Jobless Claims (Jan 3): 208K vs 210K forecast, 199K previous

Trade Gap (Oct): -$29.40B vs -$58.9B forecast, -$52.8B previous

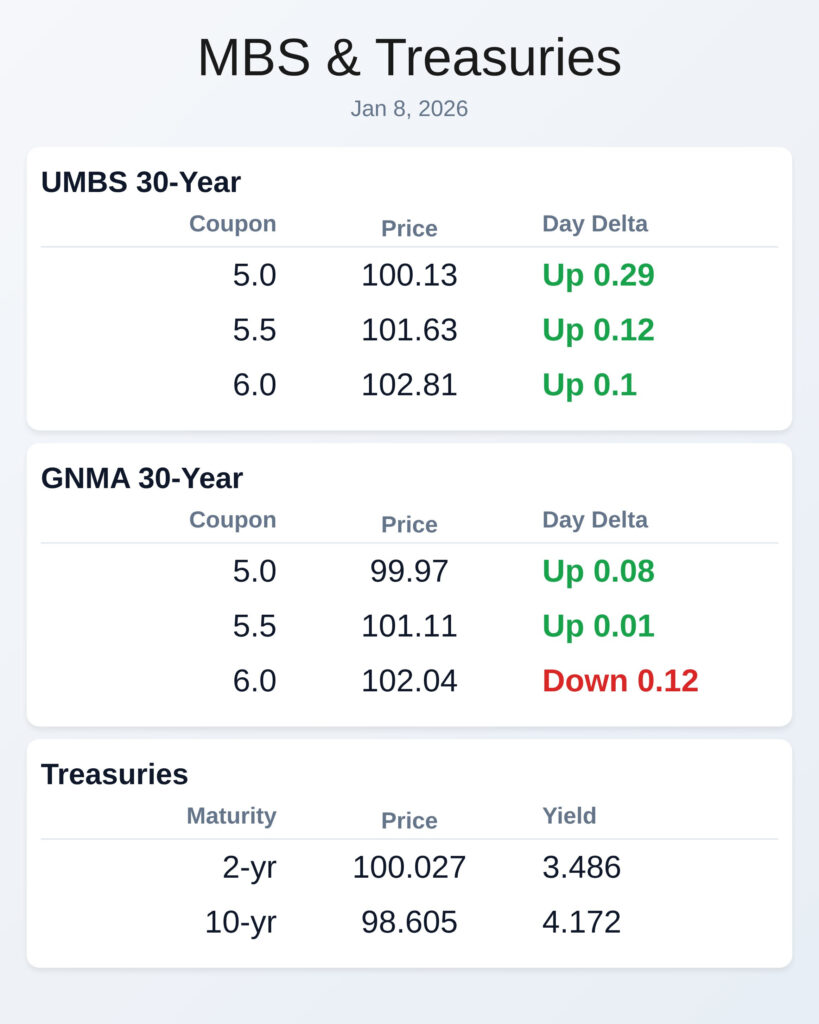

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.73 | -0.11 |

| 5.5 | 101.42 | -0.08 |

| 6.0 | 102.69 | -0.03 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.78 | -0.1 |

| 5.5 | 101.08 | -0.03 |

| 6.0 | 102.16 | 0 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.486 | 100.027 | 0.015 |

| 3 yr | 3.549 | 99.862 | 0.022 |

| 5 yr | 3.729 | 99.53 | 0.025 |

| 7 yr | 3.94 | 98.847 | 0.028 |

| 10 yr | 4.177 | 98.568 | 0.022 |

| 30 yr | 4.855 | 96.38 | 0.027 |