WTMS Blog Today = What’s up in Mortgage Today (PM) – 11/13/2025

Don’t get excited about the government shutdown ending – that was already priced into markets by mid-November. MBS securities are showing weakness today with the 30-year UMBS 5.0 coupon dropping 13 basis points to 99.36. This pullback was expected as bonds react modestly to the reopening news.

The 10-year Treasury yield climbed 4.5 basis points to 4.109%, pushing mortgage rates slightly higher for tomorrow’s rate sheets. While the government is back online, the real data won’t flow immediately – only the September jobs report might surface this week since it was largely prepared before the shutdown. Markets are positioning cautiously ahead of the $25 billion 30-year Treasury auction at 1:00 PM.

Fed uncertainty is building as money markets now price December rate cut odds at essentially 50/50. Atlanta Fed President Raphael Bostic announced his retirement effective February 28, 2026, adding to the central bank leadership changes under President Trump’s influence. The next CPI print will arrive on the morning of the Fed meeting, while the next jobs report lands during the Fed’s blackout period.

Locking vs Floating

Yields and rates are testing the lower boundaries of November’s narrow trading range thanks to weak ADP data. While government reopening could introduce volatility, the scope may be limited by delayed economic data releases. MBS prices declined 5 ticks during morning trading, with the 10-year yield up nearly 5 basis points since rate sheets were issued.

Today’s Events

– ADP Weekly Payrolls (Tuesday, 11/11): -11k

– 1:00 PM: 30-Year Treasury Bond Auction ($25 billion)

Bond Pricing

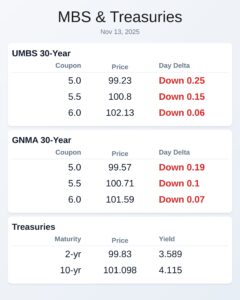

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.36 | -0.13 |

| 5.5 | 100.9 | -0.05 |

| 6.0 | 102.15 | -0.04 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.55 | -0.21 |

| 5.5 | 100.75 | -0.06 |

| 6.0 | 101.63 | -0.03 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.596 | 99.816 | 0.03 |

| 3 yr | 3.594 | 99.735 | 0.036 |

| 5 yr | 3.707 | 99.629 | 0.041 |

| 7 yr | 3.888 | 99.921 | 0.041 |

| 10 yr | 4.109 | 101.15 | 0.045 |

| 30 yr | 4.687 | 101.011 | 0.026 |