WTMS Blog Today = What’s up in Mortgage Today (PM) – 11/14/2025

Mortgage securities staged a mysterious rally at 7am this morning before surrendering most gains by noon. UMBS 5.0 coupons jumped 16 basis points early, only to give back 10 basis points as stock markets opened. This dramatic reversal left lenders who issued early rate sheets potentially considering afternoon reprices.

The morning’s movement defied easy explanation, with bonds rallying despite only modest stock weakness overnight. Treasury yields dropped as much as 5 basis points on the 10-year before climbing back toward unchanged levels. Market analysts called it a “magical mystery move” with no clear catalyst beyond potential flight-to-safety buying.

Federal Reserve officials continue signaling caution on December rate cuts, with three hawkish members scheduled to speak today. Kansas City Fed President Schmid, Dallas Fed President Logan, and Atlanta Fed President Bostic are expected to reinforce the message that more economic data is needed before additional easing. This Fed pushback has traders slashing December rate cut odds to below 50%.

The Trump administration faces mounting pressure over alleged price-fixing between Fannie Mae and Freddie Mac. Reports indicate that FHFA Director Bill Pulte’s confidant shared confidential pricing data between the GSEs, potentially exposing both companies to collusion claims. Industry observers are questioning the integrity of the housing finance system if no consequences follow.

Rice Park Capital Management acquired Charlotte-based Rosegate Mortgage to expand its mortgage servicing rights recapture strategy. The deal allows Rice Park to selectively pursue recapture across its $61 billion MSR portfolio while maintaining relationships with third-party originators. This reflects the ongoing consolidation in mortgage servicing as investors seek vertical integration opportunities.

Locking vs Floating

Government shutdown disruptions continue limiting major economic data releases, keeping bond market momentum subdued. Agencies are unlikely to release key reports without advance notice, reducing overnight volatility risk but maintaining moderate intraday swings. Current conditions favor waiting for clearer directional signals before making long-term rate commitments, though borrowers closing within two weeks should consider locking given potential Fed uncertainty.

Today’s Events

– ADP Weekly Payrolls: -11k (Tuesday, 11/11)

– Fed Speakers: Bostic, Logan, Schmid

Bond Pricing

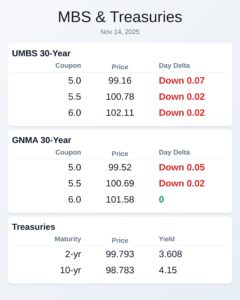

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.26 | 0.03 |

| 5.5 | 100.83 | 0.03 |

| 6.0 | 102.13 | 0 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.6 | 0.02 |

| 5.5 | 100.7 | -0.02 |

| 6.0 | 101.58 | -0.01 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.591 | 99.826 | 0.002 |

| 3 yr | 3.586 | 99.757 | -0.003 |

| 5 yr | 3.7 | 99.659 | -0.003 |

| 7 yr | 3.889 | 99.155 | 0 |

| 10 yr | 4.12 | 99.023 | 0.005 |

| 30 yr | 4.728 | 98.358 | 0.018 |