WTMS Blog Today = What’s up in Mortgage Today (PM) – 11/17/2025

The September jobs report finally releases Thursday after government shutdown delays. This marks the first major economic data to emerge since the 43-day funding crisis ended. Despite being 1.5 months old, the employment numbers can still move markets significantly, similar to how stale job openings data frequently impacts trading.

Fed Minutes from October’s meeting drop Wednesday with heightened importance. Last week’s wave of hawkish Fed commentary appears designed to prepare markets for unfriendly policy signals. Bond traders are bracing for confirmation that rate cuts may be off the table for December.

Bond markets showed modest strength overnight before pulling back at 7AM. UMBS gained 1 tick while the 10-year Treasury yield dropped 1.5 basis points to 4.135%. Government agencies are slowly announcing rescheduled economic releases for data that was ready before the shutdown.

The NY Empire State Manufacturing Index surprised to the upside at 18.7, well above the expected 6.0 reading. This regional factory data provides one of the few timely economic snapshots while federal statistics remain backlogged. Four Fed speakers are scheduled today including Jefferson, Waller, Williams, and Kashkari.

Locking vs Floating

Markets are taking cues from Fed speakers who have turned decidedly more hawkish recently. Bonds face headwinds until traders see Wednesday’s Fed minutes and gauge the central bank’s true December intentions. The combination of delayed economic data and increasingly cautious Fed rhetoric suggests volatility ahead.

Current pricing favors locking for deals closing within 30 days. Rate improvements may be limited until economic data flow normalizes and Fed policy direction becomes clearer.

Today’s Events

ADP Weekly Payrolls (Tue, 11/11): -11k

Bond Pricing

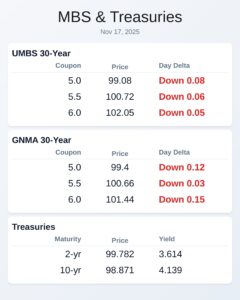

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.18 | 0.02 |

| 5.5 | 100.8 | 0.02 |

| 6.0 | 102.13 | 0.02 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.52 | -0.01 |

| 5.5 | 100.71 | 0.02 |

| 6.0 | 101.55 | -0.04 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.614 | 99.782 | 0.008 |

| 3 yr | 3.612 | 99.685 | 0.002 |

| 5 yr | 3.727 | 99.538 | -0.002 |

| 7 yr | 3.909 | 99.035 | -0.01 |

| 10 yr | 4.138 | 98.883 | -0.012 |

| 30 yr | 4.736 | 98.235 | -0.014 |