WTMS Blog Today = What’s up in Mortgage Today (PM) – 11/18/2025

Bonds found their footing today despite a confusing return of economic reports after the government shutdown. The 30-year UMBS 5.0 coupon gained 19 basis points as traders bought the dip in mortgage-backed securities. These gains came even as economic data painted a mixed picture of the labor market.

The 10-year Treasury yield dropped nearly 4 basis points to 4.10% as investors sought safe havens amid broader market weakness. Home Depot’s warning about consumer strain on big-ticket purchases sent ripples through equity markets. When stocks fall sharply, bonds typically benefit from flight-to-quality flows.

ADP’s new weekly employment report showed another decline in payrolls, supporting the bond rally that began overnight. Jobless claims for October 18th came in higher than expected at 232,000, well above the 223,000 forecast. This softer employment picture helps mortgage originators as it reduces pressure for aggressive Federal Reserve tightening.

The broader capital markets showed stress with the VIX climbing back to mid-October highs. Treasury curve steepening accelerated as investors prepared for potential policy shifts ahead. Wednesday’s Fed minutes and Thursday’s delayed September jobs report will be critical for near-term rate direction.

Locking vs Floating

The week started flat but volatility is building ahead of key events. ADP weekly payrolls and jobless claims both showed labor market softening, which bonds liked. Potential volatility remains moderate but will increase around Wednesday’s Fed minutes and Thursday’s jobs report.

MBS gained 6 ticks with the 10-year yield down nearly 5 basis points by mid-morning. While today’s data was bond-friendly, the bigger picture momentum depends on this week’s remaining economic releases.

Today’s Events

– ADP Weekly Payrolls: -2.5k vs -11.25k previous

– Jobless Claims (October 18th): 232k vs 223k forecast, 219k previous

– Factory Orders: 1.4 vs 1.4 forecast, -1.3 previous

– Builder Confidence: 38 vs 37 forecast, 37 previous

– Core Durable Goods (August): 0.4 vs 0.6 forecast/previous

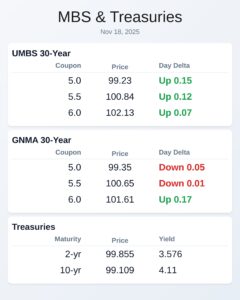

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.26 | 0.19 |

| 5.5 | 100.82 | 0.1 |

| 6.0 | 102.08 | 0.02 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.42 | 0.02 |

| 5.5 | 100.63 | -0.03 |

| 6.0 | 101.55 | 0.11 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.563 | 99.879 | -0.051 |

| 3 yr | 3.561 | 99.828 | -0.054 |

| 5 yr | 3.676 | 99.771 | -0.053 |

| 7 yr | 3.86 | 99.329 | -0.052 |

| 10 yr | 4.1 | 99.187 | -0.039 |

| 30 yr | 4.726 | 98.391 | -0.01 |