WTMS Blog Today = What’s up in Mortgage Today (PM) – 12/01/2025

December opened with bond traders hitting the panic button. UMBS securities tumbled a quarter point while 10-year Treasury yields spiked 67 basis points to 4.082%, erasing all of last week’s gains. The culprit appears to be Bank of Japan Governor Kazuo Ueda hinting at rate hikes, though the timing suggests U.S.

traders waking up to unwelcome news was the real catalyst. The Japan connection remains murky despite everyone blaming it. If the Bank of Japan was truly driving today’s selloff, we would have seen stronger correlation with dollar-yen overnight, but bond selling didn’t accelerate until domestic trading hours.

S&P futures moved with the yen selloff immediately, while Treasuries stayed flat until American traders arrived at their desks. Today’s manufacturing data added insult to injury. ISM Manufacturing Employment crashed to 44.0 versus 46.0 previously, while the main PMI reading fell to 48.2 against expectations of 48.6.

Manufacturing prices paid came in at 58.5, slightly below the 59.5 forecast, offering little comfort to mortgage originators watching their rate sheets deteriorate. The move essentially throws out Thanksgiving week’s volatility and returns us to pre-holiday ranges. For mortgage professionals, this means the brief respite in rates has ended abruptly.

Today’s levels suggest we’re back to the challenging pricing environment that defined most of November.

Locking vs Floating

Manufacturing data disappointments combined with Japan rate hike fears created perfect storm conditions today. MBS prices dropped steadily since 8 AM, with the 10-year Treasury yield climbing nearly 7 basis points by mid-morning.

Thanksgiving week’s favorable rate movement has been completely erased, returning bonds to pre-holiday resistance levels. Post-Thanksgiving volatility typically settles by the following week, but Japan’s policy shift rhetoric adds unpredictability. With Friday’s half-day session unlikely to change rate sheets significantly, originators should prepare for continued pressure.

Any clients with near-term closing needs should lock immediately given today’s sharp deterioration.

Today’s Events

– ISM Manufacturing Employment (Nov): 44.0 vs 46.0 prev

– ISM Manufacturing PMI (Nov): 48.2 vs 48.6 f’cast, 48.7 prev

– ISM Mfg Prices Paid (Nov): 58.5 vs 59.5 f’cast, 58.0 prev

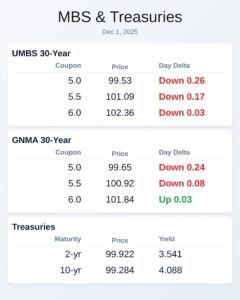

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.55 | -0.24 |

| 5.5 | 101.11 | -0.16 |

| 6.0 | 102.36 | -0.03 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.71 | -0.18 |

| 5.5 | 100.89 | -0.11 |

| 6.0 | 101.82 | 0 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.525 | 99.952 | 0.032 |

| 3 yr | 3.535 | 99.902 | 0.048 |

| 5 yr | 3.653 | 99.875 | 0.055 |

| 7 yr | 3.848 | 99.406 | 0.063 |

| 10 yr | 4.082 | 99.336 | 0.067 |

| 30 yr | 4.735 | 98.251 | 0.07 |