WTMS Blog Today = What’s up in Mortgage Today (PM) – 12/02/2025

Markets entered a period of complete silence following morning volatility that rattled bond traders. The UMBS 5.0 coupon managed only a tiny 0.01 gain to 99.54, while GNMA securities showed mixed performance. This afternoon’s calm suggests traders are waiting for clearer direction before making major moves.

Mortgage-backed securities prices remain flat after earlier turbulence shook the market. The 10-year Treasury yield climbed 2 basis points to 4.11%, continuing its upward trajectory from Monday’s sharp sell-off. Agency MBS prices stayed unchanged from Monday’s close but remain notably weaker than last week’s levels.

Manufacturing data disappointed across the board today. ISM Manufacturing Employment fell to 44.0 versus the previous reading of 46.0, while the main PMI index dropped to 48.2, missing the 48.6 forecast. These readings indicate the manufacturing sector continues its nine-month contraction streak, adding pressure to broader economic sentiment.

The bond market’s reaction to Japanese government bond volatility continues to ripple through global markets. Japan’s two-year yield surged above 1% for the first time in 17 years, raising concerns that rising Japanese rates could pull capital away from U.S. Treasuries.

This international dynamic is creating additional headwinds for mortgage originators seeking stable pricing. AI technology remains a hot topic in mortgage lending discussions. Industry experts continue debating whether AI loan officers should be licensed, as “agentic” AI systems can make autonomous decisions with minimal human intervention.

Lenders are grappling with regulatory implications as these systems become more sophisticated in handling borrower interactions and underwriting decisions. The M&A market in mortgage lending shows no signs of slowing heading into 2026. STRATMOR reports over 40 deals completed in 2025, surpassing previous years despite market improvements in the second half.

The recent Guild-Bayview transaction exemplifies strong companies joining forces rather than distressed asset sales, with Guild’s $47 million third-quarter adjusted net income demonstrating the strength behind such partnerships.

Locking vs Floating

Holiday-related market gyrations are now behind us, leaving rates in familiar November territory. Risk and reward calculations become more straightforward in the coming days, with economic data releases standing as the primary catalyst for volatility.

MBS prices provide valuable intraday risk guidance, but 10-year yield ceiling and floor levels offer better insight into broader bond market momentum patterns.

Today’s Events

ISM Manufacturing Employment (Nov): 44.0 vs 46.0 previous

ISM Manufacturing PMI (Nov): 48.2 vs 48.6 forecast, 48.7 previous

ISM Manufacturing Prices Paid (Nov): 58.5 vs 59.5 forecast, 58.0 previous

Bond Pricing

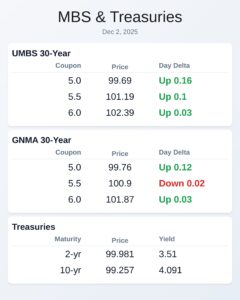

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.54 | 0.01 |

| 5.5 | 101.09 | 0 |

| 6.0 | 102.36 | 0.01 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.67 | 0.02 |

| 5.5 | 100.9 | -0.03 |

| 6.0 | 101.87 | 0.03 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.52 | 99.961 | -0.01 |

| 3 yr | 3.541 | 99.884 | -0.004 |

| 5 yr | 3.672 | 99.788 | 0.004 |

| 7 yr | 3.87 | 99.273 | 0.013 |

| 10 yr | 4.107 | 99.131 | 0.019 |

| 30 yr | 4.762 | 97.829 | 0.023 |