WTMS Blog Today = What’s up in Mortgage Today (PM) – 12/03/2025

Bond markets staged a strong rally early this morning despite lackluster reaction to the ADP employment report. Mortgage-backed securities gained over an eighth of a point by 8:30 AM, while the 10-year Treasury yield dropped 30 basis points to 4.06%. Most of these gains occurred between 6 AM and 7:30 AM ET, well before the weak ADP data was released.

The ADP report showed private employment fell by 32,000 jobs in November, far worse than the expected 10,000 gain. Surprisingly, bond markets showed little reaction to this data with remarkably light trading volume and volatility. By 8:30 AM, yields had actually returned to pre-ADP levels, suggesting the early morning rally was driven by other factors.

ISM Services data at 10 AM also failed to generate significant market reaction. The index came in at 52.6, slightly above the 52.1 forecast, while the Business Activity component hit 54.5. UMBS remained up an eighth with the 10-year yield down just 2.2 basis points at 4.069 following the release.

Mortgage Production Costs Rise Despite Rate Environment

Freddie Mac reports retail lenders spent an average of $11,800 to produce a mortgage in Q2 2025, down from Q1’s $13,400 but still elevated. Despite these rising production costs, lenders posted pre-tax income of $900 per loan – their strongest margin since 2021. The GSE emphasizes that lenders using its Loan Product Advisor system can save approximately $1,700 per loan through automated capabilities.

The cost increases reflect ongoing operational challenges in the mortgage industry. Higher expenses for technology, compliance, and staffing continue to pressure profit margins across the sector. However, improved efficiency tools and streamlined processes are helping some lenders maintain profitability despite these headwinds.

Industry Consolidation Continues with Strategic Partnership

Absolute Home Mortgage has acquired the assets of Fidelity Direct Mortgage in a strategic partnership announcement. The deal adds FDM’s 55 loan officers who originated $335 million over the past year to Absolute’s platform. FDM President Maria D’Souza-Datta will join Absolute as executive operations manager and board member, citing the need for larger infrastructure and national footprint in today’s market.

This consolidation reflects broader industry trends as independent mortgage companies seek scale and operational efficiency. The partnership allows FDM to maintain its entrepreneurial culture while gaining access to expanded resources and technology platforms. Both organizations emphasized that the alignment supports long-term strategic planning and enhanced competitive positioning.

Locking vs Floating

Tuesday’s calm market conditions gave way to Wednesday’s more active trading environment with key economic releases. The ADP employment miss and mixed ISM Services data created modest volatility but no major directional moves. Wednesday represents the week’s heaviest data calendar, with continued risk through Friday’s jobs report.

Morning bond gains provide some cushion for rate improvements, though the muted reaction to weak employment data suggests markets may be looking past current economic softness. Lock-in borrowers with tight timelines should consider current levels, while float decisions depend on tolerance for Friday’s employment volatility.

Today’s Events

– ADP Employment: -32k vs 10k forecast, 42k previous

– ISM Business Activity (Nov): 54.5 vs 54.3 previous

– ISM Services PMI (Nov): 52.6 vs 52.1 forecast, 52.4 previous

– ISM Services Employment (Nov): 48.9 vs 48.2 previous

– ISM Services New Orders (Nov): 52.9 vs 56.2 previous

– ISM Services Prices (Nov): 65.4 vs 70.0 previous

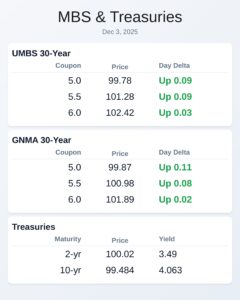

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.8 | 0.12 |

| 5.5 | 101.27 | 0.07 |

| 6.0 | 102.41 | 0.02 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.93 | 0.17 |

| 5.5 | 101.01 | 0.11 |

| 6.0 | 101.89 | 0.02 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.488 | 100.024 | -0.022 |

| 3 yr | 3.504 | 99.99 | -0.025 |

| 5 yr | 3.629 | 99.98 | -0.031 |

| 7 yr | 3.826 | 99.539 | -0.028 |

| 10 yr | 4.064 | 99.476 | -0.027 |

| 30 yr | 4.733 | 98.274 | -0.01 |

Subscribe free at WellThatMakesSense.com to get this in your inbox daily.