WTMS Blog Today = What’s up in Mortgage Today (PM) – 12/09/2025

JOLTS data threw markets a curveball this morning, sending yields higher and MBS prices lower. Job openings for October came in at 7.67 million versus expectations of around 7.2 million, signaling continued labor market strength. This unexpected resilience pushed 10-year Treasury yields up nearly 2 basis points to 4.179%.

Mortgage-backed securities dropped almost a quarter point, making pricing conditions tougher for originators. The timing couldn’t be worse with Wednesday’s Fed meeting looming. Money markets still expect a 25-basis-point cut, but the strong jobs data reinforces concerns about persistent inflation.

Central banks globally are signaling the end of their easing cycles, with Australia’s central bank declaring its rate-cutting phase over today. The combination of robust employment data and hawkish central bank sentiment is weighing on bond prices. Credit costs are becoming a strategic decision for loan officers as expenses continue climbing.

Freddie Mac’s latest data shows average retail production costs around $11,800 per loan, with credit reports eating into margins significantly. Lenders are split on whether to charge borrowers upfront for tri-merge reports or absorb costs until commitment. Industry experts suggest treating credit pulls as approval tools rather than lead generation, focusing on soft-pull alternatives early in the process.

Locking vs Floating

Today’s volatility underscores the unpredictable nature of markets through January’s second week. Economic data and events carry risk, but bonds have moved without obvious catalysts recently. Tuesday’s JOLTS data and Wednesday’s Fed announcement represent this week’s highest-risk events.

MBS prices offer intraday guidance, but 10-year yield levels help track broader bond market momentum for strategic decisions.

Today’s Events

– ADP Employment Change Weekly: 4.75K vs previous -13.5K

– CB Leading Index MoM (Sep): -0.3% vs -0.3% forecast, -0.5% previous

– JOLTS Job Quits (Sep): 3.128M vs previous 3.091M

– JOLTS Job Quits (Oct): 2.941M vs previous data unavailable

– USA JOLTS Job Openings (Sep): 7.658M vs 7.2M forecast, 7.227M previous

– USA JOLTS Job Openings (Oct): 7.670M vs previous 7.658M

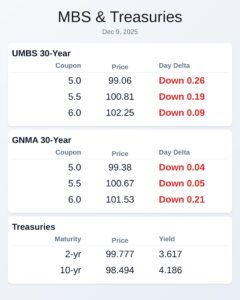

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.2 | -0.12 |

| 5.5 | 100.92 | -0.08 |

| 6.0 | 102.31 | -0.03 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.52 | 0.1 |

| 5.5 | 100.73 | 0.01 |

| 6.0 | 101.64 | -0.1 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.597 | 99.814 | 0.024 |

| 3 yr | 3.629 | 99.637 | 0.019 |

| 5 yr | 3.765 | 99.368 | 0.019 |

| 7 yr | 3.952 | 98.778 | 0.012 |

| 10 yr | 4.171 | 98.616 | 0.008 |

| 30 yr | 4.796 | 97.298 | -0.013 |