WTMS Blog Today = What’s up in Mortgage Today (PM) – 12/11/2025

Mortgage-backed securities extended gains from yesterday’s Fed rally, with UMBS 5.0 coupons up 14 basis points by midday. The 10-year Treasury yield dropped to 4.11%, helping improve pricing for mortgage originators. Today’s jobless claims data added fuel to the bond rally despite coming in higher than expected at 236,000.

The morning’s unemployment report created confusion due to seasonal adjustment issues from this year’s late Thanksgiving holiday. Initial claims jumped by 44,000, the largest increase since 2020, but continuing claims dropped to 1.84 million. MBS Live analysts explained that seasonal adjustments couldn’t properly account for the holiday timing, making the data less reliable than usual.

Fed Chair Powell’s comments yesterday reinforced that policy is now in neutral territory, with limited room for future rate cuts. The central bank upgraded its 2026 GDP outlook while trimming inflation forecasts, suggesting confidence in economic stability. Treasury yields stabilized after the announcement, with the yield curve steepening as the Fed revealed plans to buy $40 billion in Treasury bills over the next month.

Mortgage servicing rights pools continue showing interesting prepayment behavior patterns. Larger-balance UMBS 30-year pools are paying slower speeds because refinancing big mortgages remains painful when rates are high. Lower-balance pools are currently paying faster, but analysts expect this to reverse as larger-balance pools age beyond 12 months.

Locking vs Floating

The friendly reaction to yesterday’s Fed announcement helps reinforce the prevailing trading range for bonds. Risk-tolerant clients should use the ceiling of this range as a lock trigger while risk-averse clients can capitalize on today’s midday price improvements. Volatility risk decreases over the next few days but will pick back up leading to the December 16th jobs report.

Today’s Events

Jobless Claims: 236k vs 220k forecast

Continued Claims: 1838k vs 1950k forecast

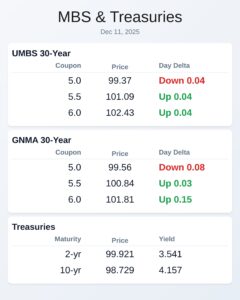

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.54 | 0.13 |

| 5.5 | 101.14 | 0.09 |

| 6.0 | 102.41 | 0.01 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.75 | 0.11 |

| 5.5 | 100.96 | 0.14 |

| 6.0 | 101.7 | 0.03 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.516 | 99.97 | -0.029 |

| 3 yr | 3.555 | 99.846 | -0.035 |

| 5 yr | 3.694 | 99.687 | -0.041 |

| 7 yr | 3.889 | 99.154 | -0.043 |

| 10 yr | 4.114 | 99.072 | -0.039 |

| 30 yr | 4.76 | 97.852 | -0.033 |