WTMS Blog Today = What’s up in Mortgage Today (PM) – 12/12/2025

Bond markets staged a “choose your own adventure” session today following yesterday’s Fed meeting. MBS prices weakened across all coupons while Treasury yields climbed higher. Chicago Fed’s Goolsbee sparked fresh doubts about the timing of this week’s rate cut.

There’s a noticeable divergence between short and long-term bonds since the Fed announcement. Two-year yields remained virtually flat while 10-year yields jumped nearly 4 basis points higher. This curve steepening forces mortgage-backed securities to absorb more selling pressure on down days.

Fed officials continue to second-guess Wednesday’s rate cut decision. Goolsbee stated there was little evidence the labor market was deteriorating fast enough to warrant the reduction. If next week’s jobs report shows strength, markets will increasingly view the Fed’s move as premature.

Mortgage rates could see modest improvements in 2026 according to industry forecasters. Major analysts predict 30-year fixed rates will hover around 6% next year – lower than 2025’s 6.6% average but far from the sub-3% rates of 2021. This would extend the gradual drift lower without materially improving affordability for most buyers.

Foreclosure activity continues rising with November marking the ninth consecutive month of year-over-year increases. ATTOM reported 35,651 properties with foreclosure filings including default notices and scheduled auctions. Foreclosure starts jumped 17% compared to last November while completed foreclosures rose 26%.

Baltimore and Philadelphia face growing investor scrutiny over non-owner occupied loans. Over the past three years, businesses connected to Benjamin Eidlisz purchased more than 700 Baltimore houses with 70% now in foreclosure. This pattern has private lenders either pricing themselves out of or completely ceasing operations in these markets.

Locking vs Floating

The friendly market reaction to the Fed announcement helps reinforce the prevailing trading range. Risk-tolerant clients should use the ceiling of this range as a lock trigger while risk-averse clients can capitalize on mid-day price improvements. Volatility risk decreases over the next few days but will pick back up leading to the December 16th jobs report.

Today’s Events

Jobless Claims: 236k vs 220k forecast

Continued Claims: 1838k vs 1950k forecast

Bond Pricing

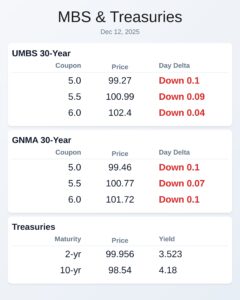

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.27 | -0.1 |

| 5.5 | 100.94 | -0.15 |

| 6.0 | 102.41 | -0.02 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.47 | -0.09 |

| 5.5 | 100.81 | -0.03 |

| 6.0 | 101.63 | -0.18 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.543 | 99.918 | 0.007 |

| 3 yr | 3.591 | 99.744 | 0.008 |

| 5 yr | 3.747 | 99.447 | 0.018 |

| 7 yr | 3.951 | 98.784 | 0.024 |

| 10 yr | 4.188 | 98.481 | 0.036 |

| 30 yr | 4.851 | 96.444 | 0.054 |