Wednesday – August 14, 2024

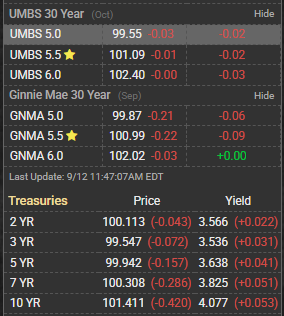

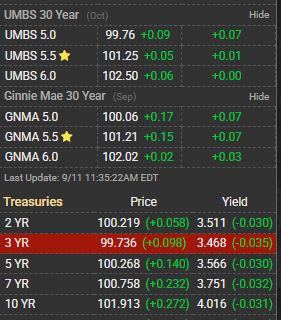

UMBS are up 6 bps on the morning. S&P Futures are down .75 points

Bonds were a bit stronger before CPI and are paradoxically losing ground after the as-expected result. The x factor is likely the pop back to 0.4 for the shelter component which had fallen to 0.2 last month. Or maybe after the BLS jobs data was such a huge miss earlier this month markets were thinking that inflation would come in even lower than expected

Headline CPI M/M = 0.2 vs 0.2 f’cast

Headline CPI Y/Y = 2.9 vs

Core M/M CPI = 0.2 vs 0.2 f’cast, [0.1 prev] (unrounded, 0.165)

Core Y/Y CPI = 3.2 vs 3.2 f’cast, [3.3 prev]

Shelter rose 0.4%, which accounted for 90% of the increase in the index.

This number probably gives the Fed the comfort they need to begin cutting rates in September. The Fed Funds futures see a 100% chance of a September rate cut, with a 56% chance of a 25 basis point cut and a 44% chance of a 50 basis point cut.

Just to be clear, mortgage rates are currently almost 100% based on the anticipation of Fed rate cuts. When the cuts are speculated to be bigger or that more of them are coming, we see better mortgage rates. When the cuts seem less likely, rates creep higher. This current inflation report tipped the scales of a September Fed rate cut to being a quarter-point, instead of a half-point. Markets still predicting a full point in cuts by the end of the year though.

When fund managers were asked what they consider the biggest tail risk, a recession is now top for 39% of managers, up from 18% a few months ago. Geopolitical conflict is unchanged at 25%, while inflation follows at 12%, down from over 30%. A systematic credit event is cited by 11%, up slightly, then an AI bubble at 7%, and lastly a US election sweep at 4%, down from 13%.

Over the past year, the average CPI day can be picked out on a chart of daily bond market movement because it is often the biggest candlestick (or bar on a bar chart) between the 10th and 15th of any given month. This was not destined to be the case today. The as-expected result was the crux of the problem. Even when looking beyond the headline numbers, there were offsetting factors with the unrounded number being bond friendly and the shelter component making the opposite argument.

UMBS ended the day up 6 bps at 100.71