**WTMS Blog Today = What’s up in Mortgage Today (AM) – 8/7/2025**

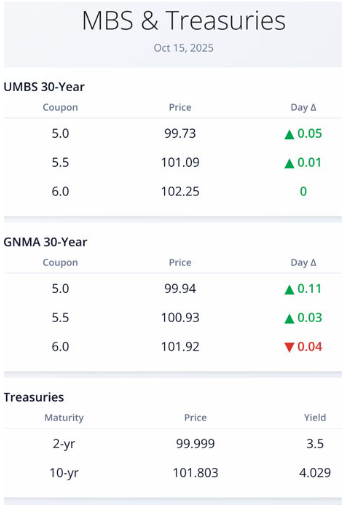

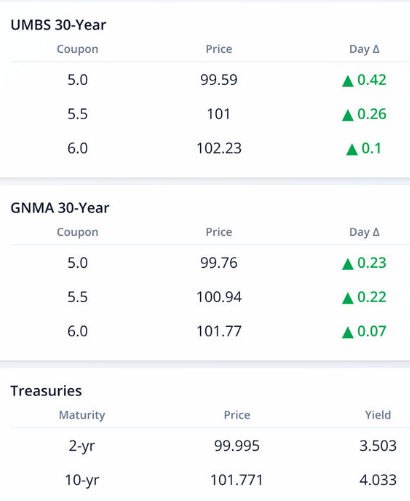

The mortgage-backed securities market is showing mixed signals this Monday morning as traders digest recent Federal Reserve communications and prepare for this week’s FOMC meeting. Treasury bonds are experiencing modest volatility with the 10-year yield hovering around 4.22%, down slightly from Friday’s close of 4.232%, indicating some price improvement in bond markets. UMBS (Uniform Mortgage-Backed Securities) pricing is reflecting cautious optimism as investors weigh potential Fed policy shifts against persistent inflation concerns. The bond market’s current trajectory suggests mortgage rates may see slight downward pressure today, though the movement appears contained pending Wednesday’s Fed decision. GNMA securities are trading in line with broader agency MBS trends, with prices showing marginal gains that could translate to modest rate improvements for borrowers. Market participants are particularly focused on Fed Chair Powell’s upcoming commentary regarding the central bank’s approach to future rate cuts. Mortgage originators are navigating a challenging landscape as purchase activity remains constrained by affordability concerns, while refi volume continues to struggle with rates still elevated compared to recent years. The industry is closely monitoring bond price movements for any signs of sustainable rate relief that could stimulate lending activity heading into 2025. Treasury market dynamics remain the primary driver of mortgage pricing, with geopolitical factors and economic data releases continuing to influence daily bond movements. Real estate professionals are reporting continued buyer hesitation despite slight improvements in inventory levels across many markets. The mortgage industry anticipates increased volatility through year-end as institutional investors adjust portfolios and market makers prepare for holiday trading patterns. Today’s bond market performance will likely set the tone for mortgage rate offerings, with lenders watching for any sustained improvement in MBS pricing that could justify rate sheet improvements. Current market conditions suggest borrowers should remain attentive to intraday rate movements, as the fluid nature of today’s bond markets could create brief windows of opportunity for those ready to lock rates.