WTMS Blog Today = What’s up in Mortgage Today (AM) – 08/20/2025

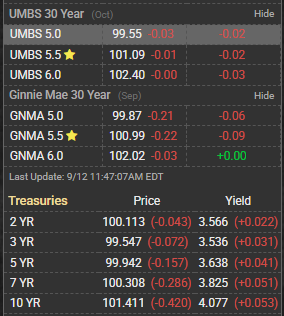

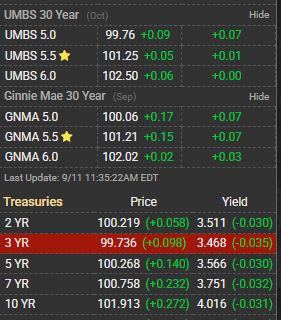

Mortgage Backed Securities markets are showing relative stability this morning, with UMBS prices holding fairly steady ahead of key economic data releases later this week. The bond market appears to be in a wait-and-see mode as traders position themselves for potential Federal Reserve policy signals. Treasury yields remain contained within recent trading ranges, providing some support for mortgage rate stability. The 10-year Treasury bond is trading with modest fluctuations, maintaining levels that have kept mortgage rates from experiencing significant volatility. Bond traders are closely watching for any shifts in Fed rhetoric that could impact long-term interest rate expectations. Current pricing suggests the market is pricing in a measured approach to future monetary policy changes. GNMA securities continue to track alongside broader MBS performance, with institutional demand remaining steady despite ongoing concerns about housing market dynamics.

The secondary mortgage market is functioning efficiently, with adequate liquidity supporting normal trading operations. Spread relationships between different mortgage security classes remain within historical norms. Mortgage originators are navigating a challenging environment where rate volatility has created uncertainty for both borrowers and lenders. Purchase application volume continues to face headwinds from affordability constraints, while refinance activity remains subdued due to the limited pool of borrowers who could benefit from current rates. Industry participants are focusing on operational efficiency and maintaining profitability in a lower-volume environment.

The housing market continues to grapple with inventory shortages and affordability challenges, creating a complex backdrop for mortgage professionals. Real estate agents report that qualified buyers remain active but are increasingly selective about properties and pricing. Market dynamics suggest that any significant improvement in mortgage rates could quickly stimulate increased activity across both purchase and refinance segments. Looking ahead, market participants will be monitoring economic indicators and Fed communications for directional guidance on interest rates and mortgage market conditions. Subscribe to get this mortgage market intelligence delivered to your inbox daily, completely free.