WTMS Blog Today = What’s up in Mortgage Today (PM) – 09/03/2025

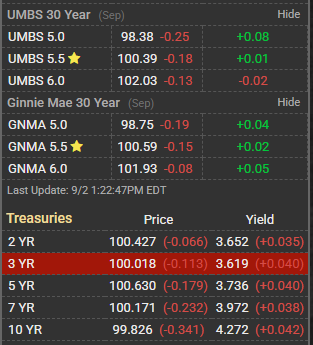

Bond markets showed signs of stabilization this morning as Treasury yields pulled back from recent highs, providing some relief to mortgage-backed securities. The 10-year Treasury yield fell slightly as investors digested incoming labor market data and reassessed Fed policy expectations. Global bond markets are finding temporary footing despite ongoing concerns about fiscal pressures and economic uncertainty ahead. Mortgage-backed securities are trading modestly higher this morning, with UMBS pricing showing green arrows indicating improved values from yesterday’s close. The mortgage-backed securities market is benefiting from the slight retreat in Treasury yields and renewed investor appetite for agency debt. MBS spreads to Treasuries remain relatively wide but have shown some compression as demand returns to the sector.

Mortgage rates continue to hover near their lowest levels in nearly 11 months, though they ticked up slightly overnight according to Bankrate’s latest survey. The 30-year fixed rate is sitting around 6.49% according to MBS Live, representing a modest decline from recent peaks. Lenders are cautiously optimistic about pricing but remain watchful of bond market volatility that could impact rate sheets throughout the day. Industry consolidation news dominated headlines as Mr. Cooper shareholders approved their merger with Rocket Companies, creating one of the largest mortgage servicing entities in the market. This mega-merger reflects ongoing consolidation pressures in the mortgage origination space as companies seek scale advantages in a challenging rate environment. The combined entity will service over $1 trillion in mortgage loans and significantly reshape the competitive landscape.

Fed policy expectations continue to drive market sentiment, with traders positioning for potential dovish signals as economic data softens. Labor market indicators are being closely watched for signs of cooling that could prompt more aggressive Fed easing. The upcoming jobs report will be critical in determining whether recent bond market stability can be sustained.

Subscribe to get this essential mortgage market intelligence delivered to your inbox daily, for free. Stay ahead of rate movements and industry developments that impact your business.