WTMS Blog Today = What’s up in Mortgage Today (09/22/2025)

Mortgage-backed securities (MBS) markets showed mixed activity today with a general softening observed in UMBS prices, reflecting cautious sentiment among investors. The UMBS 30-Year prices saw slight declines, particularly at the 5.0 and 5.5 coupons, indicating moderate selling pressures in this key benchmark area. In contrast, GNMA securities experienced some modest gains, especially at the 5.0 and 5.5 tiers, suggesting selective appetite among institutional buyers for government-backed mortgage pools. The yield on the 10-year Treasury note edged lower today, with prices slightly up, as investors digested stronger-than-expected labor market data coupled with signs of slowing inflation. These economic signals supported a risk-on environment, prompting a mild rebound in certain risk assets which indirectly influenced mortgage markets.

However, the cautious stance persists due to underlying uncertainties about future Federal Reserve policy direction. In the mortgage origination arena, loan application volumes showed signs of stabilization despite rising rates, reflecting borrower adaptation to current financial conditions. Lenders report increased demand for adjustable-rate mortgages as consumers seek to hedge against potential further interest rate increases. Correspondingly, pipeline pull-through rates have improved modestly, possibly driven by better alignment of loan pricing and investor demand in MBS markets. Real estate sales activity remains resilient in several regions, buoyed by steady employment and wage growth. However, affordability challenges remain a key concern, influencing buyer behavior towards more modest home purchases and greater use of government-insured financing options.

Market participants note growing interest in refinancing among homeowners with higher-rate mortgages locked in during previous tightening cycles. Overall, the mortgage and bond markets reflect a complex interplay of economic fundamentals and monetary policy signals. Investors and originators are closely monitoring the MBS pricing trends, especially in UMBS sectors, while watching Treasury yields as a barometer for broader fixed income market sentiment. These dynamics continue to shape mortgage rate movements and the trajectory of housing finance conditions.

For real-time updates on MBS prices and Treasury yields, stay tuned and subscribe to receive your daily dose of mortgage market insights, delivered right to your inbox—free of charge.

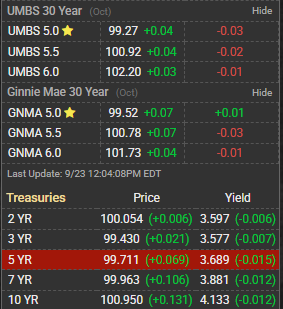

Real-Time Pricing

UMBS 30-Year: –

– 5.0: Price 99.47, Day Δ -0.07

– 5.5: Price 101.05, Day Δ -0.02

– 6.0: Price 102.30, Day Δ +0.03

GNMA 30-Year:

– 5.0: Price 99.72, Day Δ +0.14

– 5.5: Price 100.91, Day Δ +0.09

– 6.0: Price 101.79, Day Δ +0.03

Treasuries:

– 2-yr: Price 100.094, Yield 3.576

– 5-yr: Price 99.743, Yield 3.682

– 10-yr: Price 100.996, Yield 4.127