WTMS Blog Today = What’s up in Mortgage Today (PM) – 09/23/2025

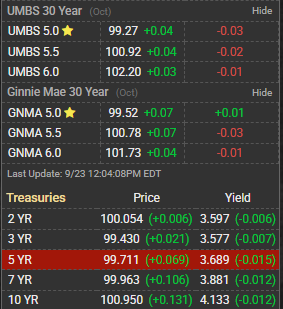

Treasury yields showed mixed movement today as Federal Reserve officials continued their policy discussions following last week’s rate cut decision. The 10-year Treasury yield held relatively steady overnight but faced upward pressure as investors digested comments from various Fed speakers. Market participants remain cautious about the Fed’s future policy path, with many questioning whether the 50 basis point cut was appropriate given current economic conditions. Mortgage-backed securities pricing reflected the underlying Treasury volatility, with UMBS showing modest weakness throughout the morning session. Primary mortgage rates remained roughly unchanged from Friday’s levels, though lenders continue to price defensively given the recent rate volatility. The MBS market appears to be finding some stability after last week’s significant moves following the Fed’s outsized rate cut.

Economic data releases were limited today, leaving traders to focus on Fed speak and technical trading patterns. Several Fed officials are scheduled to speak this week, which could provide additional clarity on the central bank’s thinking regarding future policy moves. The market is particularly sensitive to any comments suggesting the Fed may pause or slow the pace of future cuts. Mortgage origination activity continues to face headwinds despite the recent decline in rates, with many borrowers still finding current levels unattractive compared to their existing mortgages. Purchase market activity remains sluggish as affordability challenges persist in many markets.

Refinance applications have shown only modest improvement, reflecting the limited pool of borrowers who would benefit from current rates. Looking ahead, this week’s key economic releases include the PCE inflation data, which remains the Fed’s preferred inflation measure. Any surprises in the inflation data could significantly impact both Treasury yields and mortgage pricing. Market participants are also watching for additional clarity from Fed officials regarding their assessment of current economic conditions.

Subscribe to get this mortgage market analysis delivered to your inbox daily, for free, and stay ahead of the curve on bond market movements that impact your mortgage decisions.