WTMS Blog Today = What’s up in Mortgage Today (AM) – 01/09/2026

MBS markets exploded higher this morning after Trump announced his plan to buy $200 billion in mortgage bonds. The president instructed Fannie Mae and Freddie Mac to purchase these securities using their cash reserves to drive down mortgage rates and monthly payments. This parallels the Federal Reserve’s massive bond-buying program during the pandemic that pushed rates to historic lows.

Meanwhile, this morning’s jobs report came in relatively tame with mixed results. Nonfarm payrolls added just 50,000 jobs versus the 60,000 forecast, while unemployment dropped to 4.4% from the expected 4.5%. Labor force participation also declined to 62.4%, which somewhat diminishes the positive impact of the lower unemployment rate.

MBS prices surged over half a point initially but have since cooled as traders regained their composure. The 30-year UMBS 5.0 coupon is currently up about 27 basis points, while Treasury yields remain relatively unchanged. This dramatic outperformance of mortgage bonds versus Treasuries is directly attributable to Trump’s bond purchase announcement.

Locking vs Floating

Friday’s jobs report typically carries significant volatility potential for bond markets, though this one threaded the needle without major directional movement. However, MBS experienced massive swings throughout the morning due to Trump’s mortgage bond buying headlines. While mortgage-backed securities continue to outperform Treasuries significantly, they’ve dropped from their morning highs as cooler heads prevailed.

Today’s Events

– Non Farm Payrolls (Dec): 50K vs 60K forecast, 64K previous

– Participation Rate (Dec): 62.4% vs 62.5% previous

– Unemployment rate (Dec): 4.4% vs 4.5% forecast, 4.6% previous

Bond Pricing

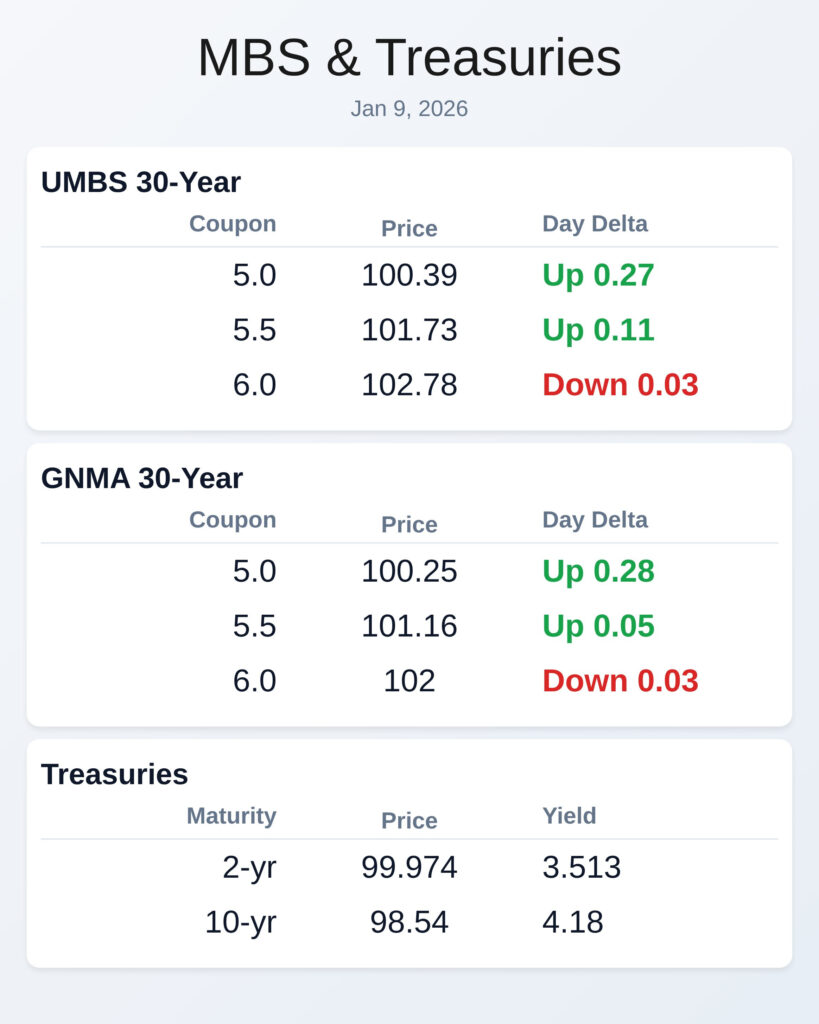

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 100.39 | 0.27 |

| 5.5 | 101.73 | 0.11 |

| 6.0 | 102.78 | -0.03 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 100.25 | 0.28 |

| 5.5 | 101.16 | 0.05 |

| 6.0 | 102 | -0.03 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.513 | 99.974 | 0.027 |

| 3 yr | 3.572 | 99.796 | 0.026 |

| 5 yr | 3.747 | 99.451 | 0.021 |

| 7 yr | 3.955 | 98.757 | 0.021 |

| 10 yr | 4.18 | 98.54 | 0.008 |

| 30 yr | 4.846 | 96.521 | 0.009 |