WTMS Blog Today = What’s up in Mortgage Today (09/19/2025)

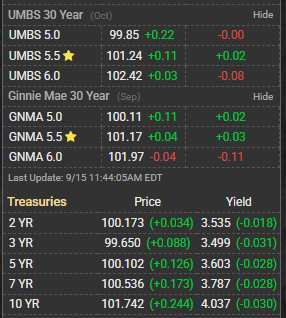

Mortgage-backed securities (MBS) experienced a modest downturn today, with prices reflecting a slight decrease in demand, influenced primarily by rising yields in the 10-year Treasury bond market. The 10-year Treasury yield opened at 4.11%, reaching an intraday high of 4.145%, and closed slightly higher than the previous day at around 4.104%. This upward pressure on Treasury yields often signals higher mortgage rates as fixed income investors seek better returns, impacting the cost of mortgage borrowing. In the UMBS market, which holds the top priority in investor attention, prices softened due to this bond yield movement, reflecting cautious sentiment. GNMA securities, while generally more stable due to their government guarantee, also saw mild pressure on their prices aligned with broader market trends. Overall, mortgage rates are poised for a slight increase, which could temper refinance activity but is unlikely to stall purchase demand.

Mortgage originators report an ongoing robust pipeline, albeit slightly slower than earlier this year, as consumers adjust to the current rate environment. Refinancing remains subdued due to higher borrowing costs, but purchase demand from first-time buyers and minority groups continues to sustain market activity. Industry experts, including Barry Habib and Matthew Graham, highlight the importance of monitoring bond market fluctuations for early signals of rate changes.

Real estate sales continue to show resilience, supported by demographic trends and labor market dynamics, though affordability remains a critical concern. Housing inventory is stable but with regional disparities influencing pricing and sales velocity. Economic data pointing to slowing job growth and inflation hitting forecast targets suggests that the Federal Reserve may signal a pause in rate hikes soon, which the bond market is tentatively pricing in. Overall, today’s market tells a story of cautious optimism with an eye on interest rate trajectories.

For mortgage professionals, understanding these bond market signals is vital to advising clients effectively. The mortgage and real estate sectors remain closely intertwined with Treasury movements, making daily updates crucial. Stay informed with these timely updates to navigate the ever-changing mortgage landscape. Subscribe now to get this essential information delivered directly to your inbox every morning, free of charge.