WTMS Blog Today = What’s up in Mortgage Today (AM) – 12/01/2025

Mortgage bonds started December with a sharp selloff as markets wiped out last week’s gains. The Bank of Japan’s comments about potential rate hikes sent global bond markets tumbling in early trading. UMBS 5.0 coupons dropped 24 basis points while the 10-year Treasury jumped to 4.08%, threatening to push mortgage rates higher for your afternoon rate sheets.

Today’s weakness appears tied more to post-Thanksgiving volatility than fundamental economic changes. While Japanese central bank policy shifts have historically rattled US markets, the timing suggests domestic traders reacting to overnight news rather than true correlation. Manufacturing data released this morning showed continued weakness, with ISM employment falling to 44.0 and the overall PMI declining to 48.2.

The Federal Reserve enters its blackout period this week ahead of the December 17-18 meeting where a 25 basis point rate cut remains nearly certain. Kevin Hassett appears to be the frontrunner for Fed Chair, though President Trump hasn’t made an official announcement. The combination of Fed uncertainty and Japanese policy shifts creates a challenging backdrop for rate predictions through year-end.

Locking vs Floating

Thanksgiving week volatility has returned rates to pre-holiday ranges, erasing Tuesday’s favorable levels. Today’s ISM manufacturing data reinforced economic weakness but hasn’t provided enough support to offset global bond market pressure. Consider locking deals with 30-day closings given the potential for additional volatility before the December FOMC meeting.

Today’s Events

– ISM Manufacturing Employment (Nov): 44.0 vs 46.0 previous

– ISM Manufacturing PMI (Nov): 48.2 vs 48.6 forecast, 48.7 previous

– ISM Manufacturing Prices Paid (Nov): 58.5 vs 59.5 forecast, 58.0 previous

Bond Pricing

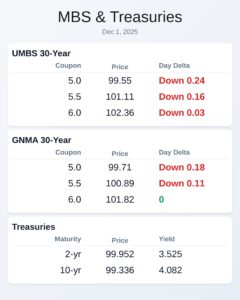

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.55 | -0.24 |

| 5.5 | 101.11 | -0.16 |

| 6.0 | 102.36 | -0.03 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.71 | -0.18 |

| 5.5 | 100.89 | -0.11 |

| 6.0 | 101.82 | 0 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.525 | 99.952 | 0.032 |

| 3 yr | 3.535 | 99.902 | 0.048 |

| 5 yr | 3.653 | 99.875 | 0.055 |

| 7 yr | 3.848 | 99.406 | 0.063 |

| 10 yr | 4.082 | 99.336 | 0.067 |

| 30 yr | 4.735 | 98.251 | 0.07 |