WTMS Blog Today = What’s up in Mortgage Today (AM) – 12/17/2025

Mortgage rates climbed higher again after last week’s Fed rate cut, creating the paradoxical situation we’ve seen repeatedly this year. The 30-year UMBS 5.0 coupon dropped to 99.47, down 7 basis points overnight. This movement signals rates are heading upward despite the central bank’s monetary easing.

November’s jobs report delivered mixed signals to bond markets. The U.S. added just 64,000 jobs while unemployment rose to 4.6%, the highest since the pandemic recovery.

Despite headline weakness, markets reacted calmly as federal employment cuts from the Trump administration skewed the data lower. Mortgage application volume fell 3.8% last week as borrowers stepped back from higher rates. Purchase applications dropped 3% while refinance activity declined 4%, though refi volume remains 86% higher than last year.

This pullback follows the familiar pattern where Fed cuts paradoxically push mortgage rates higher. The labor market shows deeper weakness beneath the surface statistics. Nearly one million more workers are involuntarily working part-time, and underemployment jumped significantly.

Markets expect this deterioration to support additional Fed rate cuts in March and June 2026, though mortgage rates may not respond as borrowers hope. Kenny Smith officially starts today as Freddie Mac’s new CEO, replacing interim chief Michael Hutchins. His 27-year Deloitte background includes extensive work with major banks like Wells Fargo.

His compensation will be capped at $600,000 annually, though other Agency employees earn significantly more. The 10-year Treasury yield climbed to 4.17% as investors focus on Thursday’s inflation data. Bond yields have traded in a 4.00% to 4.20% range since September, but this range will eventually break.

Capital markets analysts expect the 4.00% floor to give way before yields reach 4.25%.

Locking vs Floating

Risk-averse clients should view recent market action as suggesting resistance to rapid rate improvement before year-end. Despite unemployment rising, the bond market response fell short of expectations for a meaningful rally.

Pragmatic originators assume bigger moves await Thursday’s CPI data rather than betting on immediate improvement.

Today’s Events

No major economic data releases scheduled

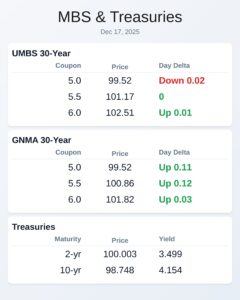

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.52 | -0.02 |

| 5.5 | 101.17 | 0 |

| 6.0 | 102.51 | 0.01 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.52 | 0.11 |

| 5.5 | 100.86 | 0.12 |

| 6.0 | 101.82 | 0.03 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.499 | 100.003 | 0.009 |

| 3 yr | 3.54 | 99.887 | 0.013 |

| 5 yr | 3.704 | 99.641 | 0.008 |

| 7 yr | 3.91 | 99.027 | 0.008 |

| 10 yr | 4.154 | 98.748 | 0.014 |

| 30 yr | 4.827 | 96.813 | 0.014 |