WTMS Blog Today = What’s up in Mortgage Today (PM) – 10/03/2025

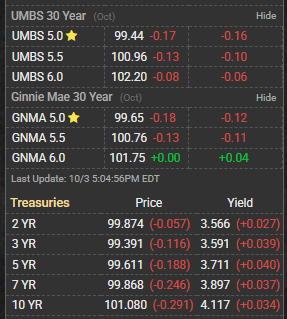

Treasury yields climbed today despite weaker-than-expected U.S. services data, creating headwinds for mortgage-backed securities prices. The 10-year Treasury bond continues to show volatility as markets digest mixed economic signals and ongoing government shutdown concerns entering its third day. This upward pressure on yields typically translates to higher mortgage rates for borrowers. Mortgage rates remain elevated at 6.36% for 30-year fixed loans, unchanged from recent sessions as MBS prices face downward pressure from rising Treasury yields. The disconnect between weak economic data and rising yields suggests investors are pricing in other factors beyond immediate economic fundamentals.

Lock/float considerations favor locking in current rates given the uncertain Treasury market dynamics. The mortgage-backed securities market is experiencing some volatility as institutional investors reassess risk profiles amid the government shutdown uncertainty. UMBS (Uniform Mortgage-Backed Securities) pricing remains under pressure as the broader bond market grapples with conflicting signals from economic data versus fiscal policy concerns. Trading volumes have been moderate as market participants await clearer direction from both economic releases and political developments. Major stock indexes closed at record highs today, with the Dow and S&P 500 capping another winning week despite the bond market challenges. This equity strength versus bond weakness dynamic reflects investor preference for risk assets over fixed income in the current environment.

The divergence between stock and bond performance continues to influence capital flows away from mortgage-backed securities. Industry professionals are advising clients to monitor rate movements closely given the fluid nature of current market conditions. The combination of government shutdown concerns, mixed economic data, and technical factors in the bond market creates an environment where rates could move quickly in either direction. Borrowers with near-term closing needs should consider rate protection strategies given the elevated volatility. Looking ahead, market participants will be watching for resolution of the government shutdown and upcoming economic releases that could provide clearer direction for interest rate trends. The mortgage origination business continues to adapt to the higher rate environment, with lenders focusing on purchase money transactions as refinance activity remains subdued.

**Subscribe to get this mortgage market analysis delivered to your inbox daily, for free, and stay ahead of the rate movements that impact your business and clients.**