WTMS Blog Today = What’s up in Mortgage Today (PM) – 12/29/2025

Bond markets held mostly sideways despite modest help from European trading sessions overnight. MBS prices gained two ticks while the 10-year Treasury yield dropped 1.6 basis points to 4.117%. The lack of volatility reflects typical holiday trading patterns as we approach the year’s end.

Pending Home Sales surprised to the upside at 79.2 versus the previous reading of 74.9. This economic data provided mild support to mortgage-backed securities throughout the morning. However, the impact remained limited due to reduced trading volume and liquidity.

The mortgage industry faces a quiet week ahead with markets entering peak holiday mode. Bond trading typically sees wider ranges of movement during this period, even though rates often drift sideways in December’s second half. The next significant risk for market volatility won’t emerge until the first week of January.

Agency MBS prices opened a few ticks better than Friday’s close, with UMBS coupons showing modest gains. The 30-year UMBS 5.0 coupon traded at 99.90, up 5 basis points from the previous session. This represents favorable conditions for mortgage originators looking to price loans this afternoon.

Locking vs Floating

Holiday trading conditions create unpredictable market movements that can happen without clear fundamental drivers. MBS prices currently provide helpful support for intraday risk management. However, 10-year Treasury yield levels remain the key indicator for tracking broader bond market momentum and longer-term rate direction.

With markets entering peak holiday mode, wider price swings become more likely even in a traditionally calm period. Originators with loans closing within two weeks should consider locking given the potential for unexpected volatility. The next major risk events won’t occur until early January when normal trading patterns resume.

Today’s Events

– Pending Home Sales: 79.2 vs 74.9 prev

Bond Pricing

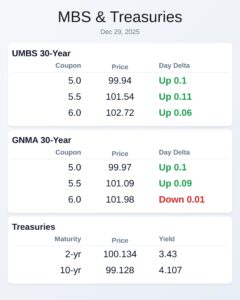

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.87 | 0.02 |

| 5.5 | 101.45 | 0.02 |

| 6.0 | 102.67 | 0.01 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 99.9 | 0.03 |

| 5.5 | 101.05 | 0.05 |

| 6.0 | 102 | 0.01 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.468 | 100.062 | -0.013 |

| 3 yr | 3.519 | 99.948 | -0.012 |

| 5 yr | 3.684 | 99.732 | -0.011 |

| 7 yr | 3.893 | 99.131 | -0.008 |

| 10 yr | 4.123 | 99.001 | -0.006 |

| 30 yr | 4.809 | 97.101 | -0.006 |