Monday – August 19, 2024

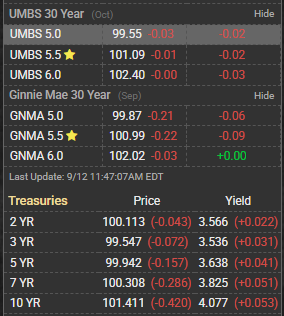

UMBS were down 3 bps in early trading. S&P futures are up 2.75 points.

The week ahead will be dominated by Fed activity, with the July FOMC minutes slated for release on Wednesday, and the Jackson Hole Symposium taking place on Thursday and Friday. Jerome Powell is set to speak on Friday. Aside from the Fed activity, we will get some real estate data with new home sales and existing home sales.

Stocks posted small moves after last week’s risk-on rally as traders await signs on the scope of potential

interest-rate cuts from the Federal Reserve.

Consumer sentiment was unchanged in August, according to the University of Michigan Consumer Sentiment Survey. Year-ahead inflation expectations were flat at 2.9. Three year inflationary expectations were 3% again, which is above the Fed’s target and higher than pre-pandemic levels.

The Democratic National Convention is this week, and Kamala Harris is expected to unveil a plan to address housing affordability. She wants to give first time homebuyers $25,000, and encourage more building. Given the paucity of starter homes to begin with, a demand stimulus will probably be ineffective and just drive up home prices at the low end.

She wants to include some tax subsidies to encourage the building of starter homes, however that probably won’t affect the regulatory red tape that is a barrier to home construction.

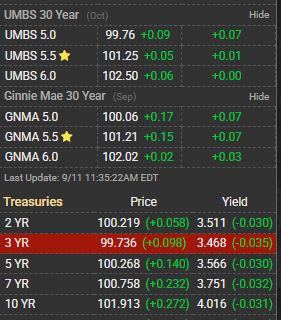

Monday started slow and stayed slow throughout. MBS held well within the narrowed intraday trading range in nearly a month in addition to hitting the 3pm bell at exactly the same levels seen at 8am. There were no relevant economic reports or market movers. Treasury volumes were right in line with the lowest levels of any day in the past month.

UMBS closed the day down 1 bp at 100.61.