**WTMS Blog Today = What’s up in Mortgage Today (AM) – 8/8/2025**

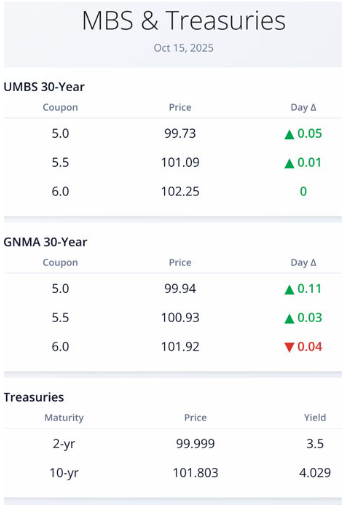

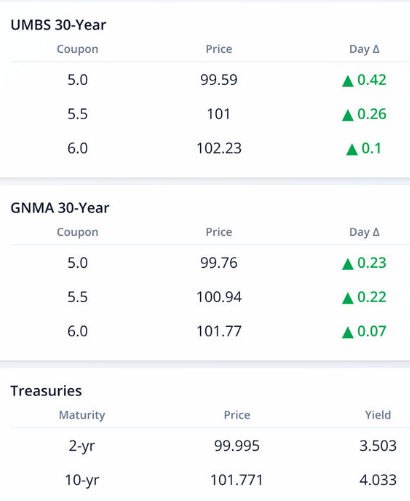

The mortgage-backed securities market is experiencing continued pressure as bond prices face headwinds following recent Federal Reserve actions and evolving economic data. Treasury bonds, particularly the 10-year note, have shown volatility with pricing changes reflecting investor uncertainty about the Fed’s future policy direction. The UMBS (Uniform Mortgage-Backed Securities) market remains under scrutiny as mortgage originators navigate shifting rate environments that directly impact loan pricing and profitability. Recent reports indicate the 30-year fixed mortgage rate has climbed to 6.72% following the latest Fed meeting, creating additional challenges for both borrowers and lenders in the current market cycle. GNMA securities continue to play a crucial role in the government-backed lending sector, though market participants are closely watching for any policy changes that could affect these instruments.

The broader mortgage origination business faces headwinds as higher rates dampen refinance activity and purchase applications, forcing many lenders to adjust their operational strategies. Bond market participants are particularly focused on upcoming economic releases that could provide direction for both Treasury and mortgage-backed securities pricing in the near term. The correlation between Treasury movements and mortgage rate changes remains strong, with any significant shifts in the 10-year yield directly impacting mortgage pricing across the industry. Market makers and originators are adjusting their hedging strategies to account for increased volatility and potential further rate movements. Industry professionals are closely monitoring Federal Reserve communications for any hints about future policy adjustments that could provide relief to the mortgage market.

The current environment requires careful attention to daily pricing changes as even small movements in bond values can significantly impact mortgage rate offerings and loan pipeline management. Real estate professionals are adapting their strategies to work within this higher-rate environment, focusing on buyers who can still qualify and complete transactions. Today’s market conditions emphasize the importance of staying informed about both immediate pricing changes and longer-term economic trends that drive mortgage and bond market performance.