Mortgage Today (PM) 08/20/2025

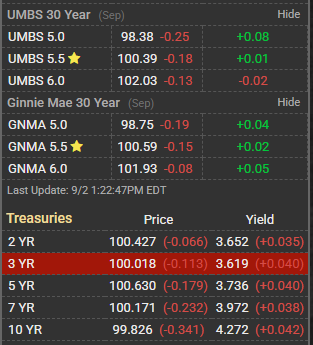

The mortgage-backed securities market experienced modest volatility today as the 10-year Treasury yield eased to 4.29%, down 2 basis points from yesterday’s session. This slight improvement in bond pricing provided some relief for MBS investors, though trading volumes remained relatively light ahead of tomorrow’s Federal Reserve meeting minutes release. UMBS 30-year securities showed resilience in afternoon trading, with the benchmark 5.5% coupon holding steady despite earlier morning pressure from retail sales data that came in stronger than expected.

Housing market dynamics continue to challenge loan officers as mortgage rates hover near 6.61% for 30-year fixed loans, reflecting the persistent spread between MBS pricing and Treasury benchmarks. The current rate environment has created a pronounced lock-versus-float decision framework, with most industry experts recommending immediate locks for borrowers with closing timelines within 30 days. Economic data releases this week, including housing starts and building permits, will likely influence MBS direction more than broader equity market movements. GNMA securities traded in line with UMBS counterparts, maintaining their typical premium to conventional mortgage bonds due to government backing. The secondary mortgage market showed signs of stabilizing after last week’s volatility, though origination volumes remain well below historical norms as affordability constraints persist across most metropolitan markets. Loan officers should prepare clients for potential rate fluctuations as the Fed’s monetary policy stance remains data-dependent, with particular attention to inflation metrics and employment trends.

Market participants are closely watching the yield curve dynamics as the 2-year/10-year spread continues to normalize from its previously inverted state. This normalization, while positive for long-term economic outlook, has created some uncertainty in MBS pricing models that had adapted to the unusual rate environment. Forward commitment pricing for October and November settlements reflects cautious optimism, with lenders maintaining conservative pricing margins to protect against potential volatility spikes.

The afternoon session showed improved liquidity in both UMBS and GNMA markets, with institutional buying supporting prices across most coupon stacks. Lock and float considerations favor immediate action for borrowers with solid loan profiles and firm closing dates, while those with longer timelines may benefit from monitoring tomorrow’s Fed minutes for policy guidance signals. Subscribe to receive this comprehensive MBS and mortgage market analysis delivered to your inbox daily, completely free. **