**WTMS Blog Today = What’s up in Mortgage Today (AM) – 09/09/2025**

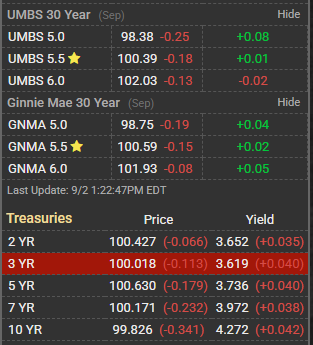

Mortgage-backed securities showed mixed signals today as the bond market continues to navigate shifting economic conditions. The 10-year Treasury yield climbed to 4.07%, representing a 0.03 percentage point increase from the previous session, which typically puts upward pressure on mortgage rates. However, MBS pricing has managed to hold relatively steady despite the Treasury movement. UMBS (Uniform Mortgage-Backed Securities) trading has been the primary focus for lenders, with pricing fluctuations creating opportunities for rate improvements throughout the morning session. GNMA securities have shown similar resilience, though volume remains lighter than typical Monday trading patterns. The disconnect between Treasury yields and MBS performance suggests strong demand from institutional investors continues to support mortgage bond pricing.

Market participants are closely watching Federal Reserve commentary and economic data releases that could influence monetary policy expectations. Rising Treasury yields reflect ongoing concerns about inflation persistence, but mortgage bonds are benefiting from technical factors including reduced supply and strong demand from banks and insurance companies. This divergence has allowed some lenders to offer slightly improved mortgage rates despite the broader bond market weakness. The mortgage origination business is experiencing seasonal patterns typical for early September, with purchase applications showing modest improvement as buyers return from summer holidays.

Refinancing activity remains subdued given the current rate environment, though lenders are positioning for potential opportunities if rates decline. Real estate professionals report steady but cautious buyer activity, with inventory levels gradually improving in most markets. For mortgage professionals, today’s market conditions suggest monitoring MBS pricing closely for potential rate improvement opportunities later in the session. The Treasury-MBS spread remains wider than historical norms, providing some cushion for mortgage rates even if Treasury yields continue to rise.

Subscribe to get this essential mortgage market intelligence delivered to your inbox daily, completely free.