WTMS Blog Today = What’s up in Mortgage Today (AM) – 10/29/2025

Mortgage rates hit their lowest level in over a year, sparking a dramatic surge in refinancing activity. The 30-year contract rate fell to 6.30% according to MBA data, triggering 111% more refinancing applications compared to the same week last year. Purchase applications also climbed 5% for the week.

This sustained decline could finally wake up the dormant housing market that’s been frozen by high rates. Markets opened modestly weaker overnight ahead of today’s Fed decision. MBS securities dropped 1 tick while the 10-year Treasury yield rose to 3.992%, up 1.6 basis points from yesterday’s close.

All eyes turn to the 2:00 PM Fed announcement and Powell’s subsequent press conference. While a 25 basis point cut is guaranteed, traders will scrutinize every word for clues about December’s meeting. Fannie Mae reported its 31st consecutive quarterly profit this morning, posting $3.9 billion in net income.

The GSE’s streak stands as a rare bright spot in residential lending, demonstrating remarkable consistency through multiple market cycles. Consumer confidence meanwhile fell for the third straight month, hitting its lowest level since April. Americans are growing increasingly pessimistic about employment prospects despite relatively stable current conditions.

Home price data showed mixed signals with Case-Shiller coming in weaker than expected. The 20-city index gained only 1.6% year-over-year versus the 1.9% forecast, while on a monthly basis prices actually declined 0.6%. However, the FHFA Home Price Index surprised to the upside with 0.4% monthly growth.

These divergent readings reflect regional variations and methodology differences between the indices.

Locking vs Floating

Current rates represent the best pricing borrowers have seen in over a year. With the Fed decision looming, traders remain cautious about which direction markets will move next.

The rate cut is fully priced in, but accompanying statements and projections could push rates higher or lower. Consider locking deals closing within 30 days given the uncertainty surrounding Fed communications.

Today’s Events

Case Shiller Home Prices-20 y/y (Aug): 1.6% vs 1.9% forecast

CaseShiller 20 mm nsa (Aug): -0.6% vs -0.3% previous

FHFA Home Price Index m/m (Aug): 0.4% vs 0.1% forecast

CB Consumer Confidence (Oct): 94.6 vs 93.2 forecast

14:00 FOMC Rate Decision

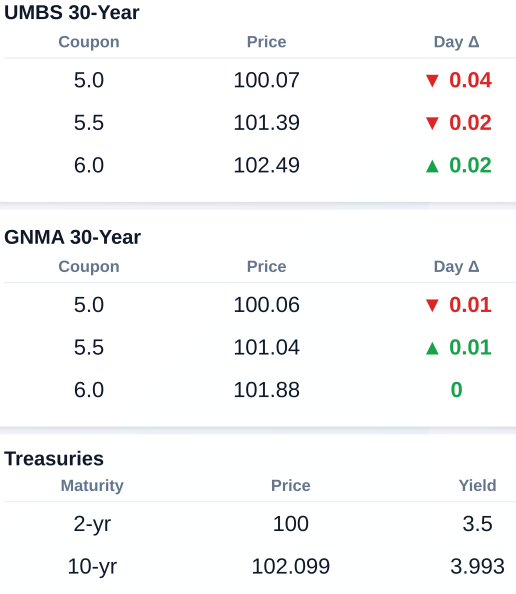

Bond Pricing

UMBS 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 100.07 | -0.04 |

| 5.5 | 101.39 | -0.02 |

| 6.0 | 102.49 | 0.02 |

GNMA 30 yr

| Coupon | Price | Intra-Day Change |

| 5.0 | 100.06 | -0.01 |

| 5.5 | 101.04 | 0.01 |

| 6.0 | 101.88 | 0 |

Treasuries

| Term | Yield | Price | Intra-Day Yield Change |

| 2 yr | 3.5 | 100 | 0.01 |

| 3 yr | 3.508 | 99.977 | 0.012 |

| 5 yr | 3.621 | 100.018 | 0.013 |

| 7 yr | 3.794 | 100.496 | 0.019 |

| 10 yr | 3.993 | 102.099 | 0.017 |

| 30 yr | 4.564 | 103.031 | 0.018 |