3 classes of factors impact what an organization can – and cannot – do:

- It’s resources: The most visible. People, equipment, technology, product designs, brand, information, cash, relationships with suppliers/distributors/customers. Usually things or assets.

- Having an abundance increases the chances of coping with change.

- What managers will most likely and quickly analyze when making decisions.

- Particularly important in the start-up phase of an organization. The departure of some key people can profoundly change the organization. Over time, the focus will shift to processes.

- It’s processes: Converts resources into something of greater worth. Manufacturing, product development, procuring, planning, employee development, compensation, resource allocation.

- Some are formal – defined, implemented, and consciously followed

- Some are informal – habitual routines that have developed over time. Hopefully because they work. Cultural

- Developed de facto. To perform a certain task. Though, this process might not be good for the next task.

- Can be abilities or disabilities. When they are too rigid, can quickly become disabilities.

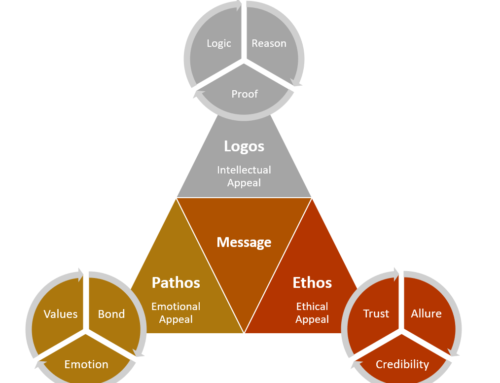

- It’s values: The criteria by which most decisions are made. Some are ethical in tone. The standards by which employees make prioritization decisions. Whether a customer/employee/idea is more or less important than others.

- The larger the organization, the more important it is for the leadership to train people on all levels of the company to make decisions based on company values.

-

- Need to be broad, consistent, and clearly understood.

- Culture allows employees to act autonomously and consistently.

- Since challenges change over time, culture has to change to adapt as well.

- Must reflect their cost structure or their business model. i.e… if the business model is designed to need a gross profit of 40% – managers will kill any idea that is less than that. Could stifle innovation.

- The values of successful firms tend to develop in 2 predictable ways in at least 2 dimensions

- As it relates to gross margins: As companies add features, to attract premium customers, they tend to add overhead cost. This increases costs and lowers margins. Toyota came to America with a low cost car. Which got replicated by rivals which threatened to lower margins further. So they had to de-emphasize these cars and pivot toward more upscale options. Which costs money, but paid off in the long run.

- How big a business has to be in order to be interesting: Mangers will not only feel pressure to maintain constant growth – but a constant rate of growth. Especially in public companies. Due to compound growth, each increment gets harder. Eventually smaller emerging markets aren’t of interest to them.